Introducing a new ongoing section of CryptoSlate — Project Reports — designed to provide a comprehensive and standardized overview of crypto projects and DeFi protocols.

This first report was conducted on Anchor Protocol, the “DeFi savings protocol” of the Terra blockchain that pays up to 19.6% APY on the UST stablecoin, which is now available on Coinbase and other major exchanges.

We hope you enjoy this first edition of CryptoSlate Project Reports.

1. Introduction

“Despite the proliferation of financial products, DeFi has yet to produce a savings product simple and safe enough to gain mass adoption.” What rate is your bank currently giving you on your savings account? The average on the high-end is only 0.5%, and if inflation is 3% per year, your hard-earned money is losing value in the bank.

Enter Anchor Protocol, which launched on March 17, 2021, it is the newest groundbreaking savings protocol built on the Terra ecosystem. Proposing low-volatile yields of up to 20% on Terra stablecoin deposits UST. The platform connects a lender, looking to earn stable yields on their stablecoins and a borrower, looking to borrow stablecoins on stakable assets.

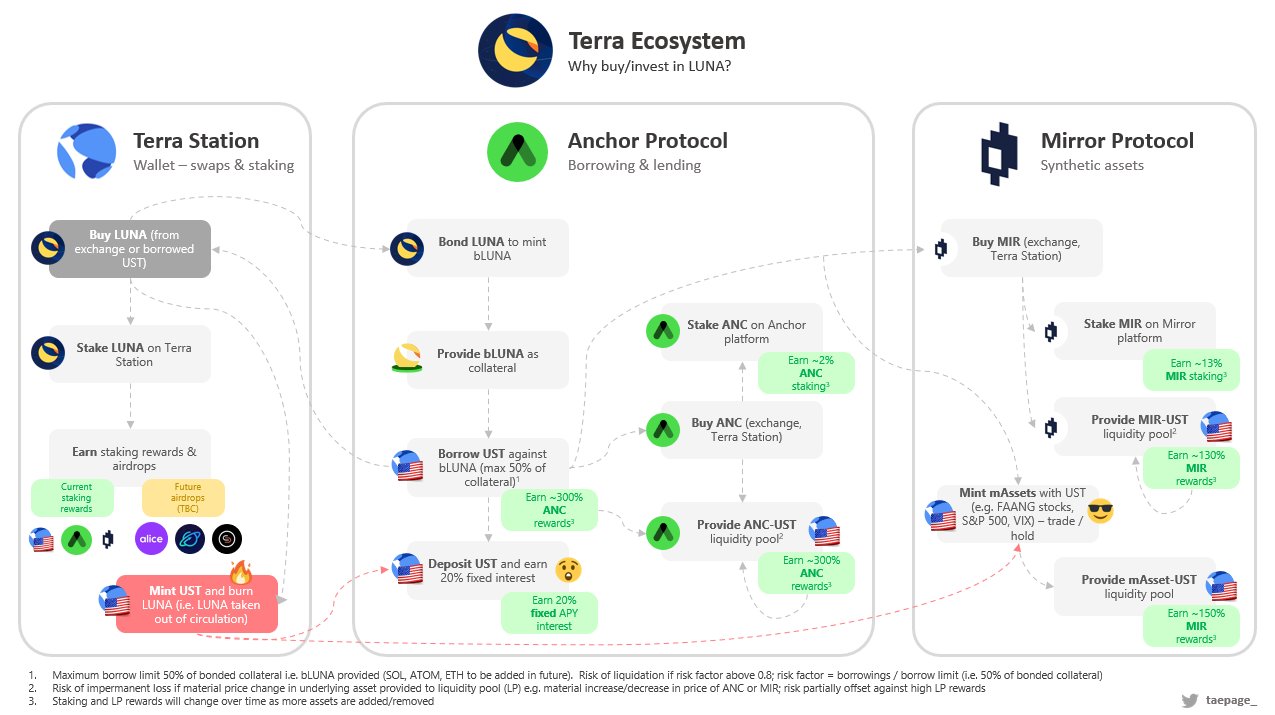

Anchor Protocol and Mirror Finance are part of a suite of financial products from Terraform Labs, which are building decentralized payments, savings, and investments at scale.

In this article, we’ll focus on Anchor Protocol, to not only show how it’s different than other DeFi savings protocols but also, how it plans to sustain the promised rate to clients to ensure reliability and long-term financial security.

Users can borrow stablecoins on Anchor by providing collateral of bonded assets (bAssets), currently in the form of bonded Luna (bLUNA) or bonded Ethereum (bETH). Lenders can earn an exceptionally high stable yield (~19.2-19.5%) in Terra USD (UST) stablecoin and by staking rewards from the universal pool of collateral of the bonded assets.

2. Market

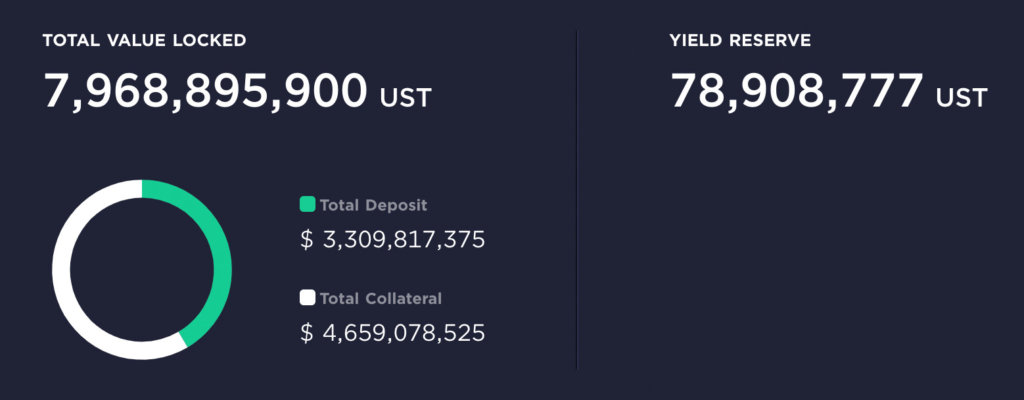

Anchor, a DeFi savings protocol, has a notable metric of $5.5 billion in total value locked. That metric is split up into a total deposit amount of $2.5 billion and total collateral of $4 billion.

It is rare to witness this type of quick adoption within any other project from other ecosystems. These metrics have propelled Anchor Protocol to the number 1 ranking within the Terra ecosystem for TVL.

Terra Ecosystem

The Terra Ecosystem comprises of a number of DeFi projects built on top of the Terra blockchain, and all integrate tightly with one another. Other notable Terra ecosystem projects include Pylon Protocol, Astroport, Valkyrie Protocol, StarTerra, and Orion Money.

Savings Rate Competitors

One of the fascinating advances within the DeFi space is that competition shines around every corner. Companies want to attract new customers by displaying the best methods for those customers to earn money. Beefy Finance, Trader Joe, and Venus Protocol are several competitors that offer savings rates for various cryptocurrencies. For a complete list of DeFi savings rates, see Coindix.

3. Technology

It is the first inter-chain DeFi application that pools the emission from PoS blockchains, stabilizes it, and passes it on as fixed, high-yield interest to depositors. The protocol uses five types of participants in the ecosystem:

- Depositor – A customer that lends Terra stablecoins into the Anchor marketplace. Next, the deposited stablecoins are pooled and loaned out to the borrowers, with accrued interest distributed to all depositors. In the transaction, the depositor will receive Anchor Terra (aTerra) as a form of trade, which will give the depositor a share in the stablecoins pool.

- Borrower – Individuals, who construct bAsset collateralized lending opportunities to borrow Terra stable currencies from the Anchor marketplace. Without losing value to the price of their bAsset collateral, borrowers can gain access to liquidity. Borrowers are incentivized by receiving Anchor Tokens, which are distributed by the protocol.

- Liquidator – Watches for the actuality of risky loans and if necessary, requests can be made to liquidated loan collaterals. Before this can be accomplished, a bid must be proposed to the Liquidation Contract, which offers to obtain the liquidated collateral in trade for the liquidators Terra stablecoin.

- ANC Liquidity Provider – Individuals that offer liquidity to the ANC-UST Terraswap Pair. They administer the primary start-up of swap liquidity between ANC and UST tokens. ANC tokens are distributed to borrowers as incentives, which are used to regulate the stablecoin deposit rate.

- Oracle Feeder – A system that provides precise and up to the second price feed for bAsset collaterals. This allows the system to calculate the collateral value of a borrower. Not only is this the creator of the Anchor protocol, but also is utilized as a reference price in the Liquidation Contract. As the protocol grows, third-party feeders will rise in support.

The Anchor Protocol is a collection of 3 components: ANC token incentives/governance, money markets and using diversified staking yields. These components help make up a fully decentralized fixed-income gadget.

- Anchor Rate: The target APY that Anchor pursues to pay out depositors. The governance is what sets the rate during a vote when setting the boundaries.

- Real Yield: Is using collateral to earn staking rewards which allow staking rewards to make up real yield.

- Stabilization around the Anchor rate happens in two different ways:

-

-

- When the Anchor Rate > real yield; ANC incentives to the borrowers surge by 50% every week until the real yield connects to the Anchor Rate.

- When the Anchor Rate < real yield; A yield reserve is created allowing the surplus of yield to be stored in UST.

-

Interchain Transfers

ANC, LUNA and TerraUSD are the native Terra tokens which are the interchain tokens. Individuals can locate these on the Binance Smart Chain, Ethereum, Terra blockchains.

Anchor Protocol uses the Shuttle bridge as a way of interchain transfers among different chains. If individuals are utilizing other blockchains besides Terra they will follow the adoption of ERC20 for Ethereum, which is the most common standard on the chain. Also, supported by a 1:1 ratio with counterparts on the Terra blockchain.

Interface

The two main interfaces that allow individuals to effortlessly execute interchain transfers are the Terra Bridge and the Terra Station.

Terra Bridge: Designed exclusively for interchain transfers on its web interface. The security that is backing this bridge allows for a significant number of validations to ensure before making the transfer happen. The short five-step progression below can take up to a few minutes:

- Connect Terra Bridge With A User-Owned Account.

- Specify Transfer Details.

- Confirm Transfer Details.

- Sign and Broadcast the Transaction.

- Transfer Request Complete.

Terra Station: Individuals can transfer assets from Terra, Ethereum and Binance Smart Chain. The security behind this bridge allows for a significant number of validations to occur before allowing the transfer. The token transfer happens in this 4-step process and could take up to a few minutes before finalization:

- Select an Asset to Transfer.

- Specify Transfer Details.

- Confirm Transfer Details.

- Transfer Request Complete.

For a step-by-step, instructional breakdown of the process, see this guide from Anchor Protocol.

Anchor Protocol Web Footprint

App – Discord – Docs – Email – GitHub – Twitter – Telegram – Website

4. Tokenomics

The governance token for Anchor Protocol is $ANC. Governance within Anchor Protocol is an additional key feature for this project. The community governance will help the progression and improvement within this platform.

When the user begins to stake $ANC on the platform, the consumer is given the right to contribute to the polls. The polls are introduced on the platform to help the development and enhancement of Anchor Protocol.

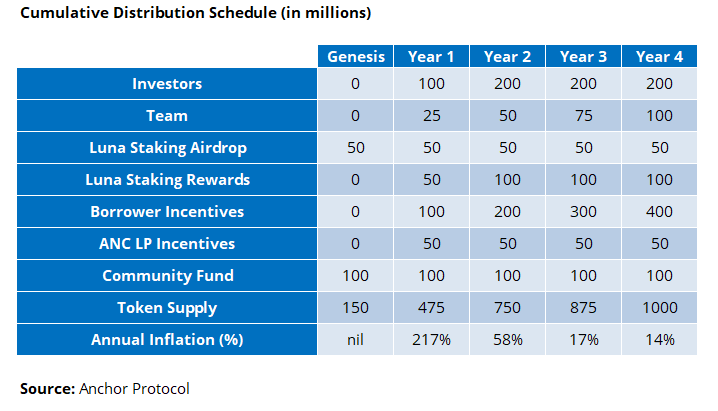

The more $ANC that the consumer is staking the more voting power he/she receives, giving the person a higher degree of impact on decisions brought up in polls. Borrowers within the protocol also receive what is known as “borrowers’ incentive” which is $ANC tokens to help contribute to larger adoption of the platform. Throughout the next four-plus years, one billion $ANC tokens will be disbursed.

Currently, the circulating supply is 177,444,246.79 ANC as of writing this article. At the current price point of $3.79, this makes $671,228,076 of Anchors’s total market cap. Generating only 18% of the max supply which is prearranged at 1,000,000,000.

The price of Anchor has fluctuated from as low as $1.68 to as high as $8.23 over its time of inception. With a growing viewership on social media of 100,000+ followers and 11,600+ Telegram users in less than a year. Anchor Protocol will continue to grow as adoption continues to trend up.

Attracting more customers can be done with enticing incentives, such as holding Anchor.

- Holders of ANC will get exposure to high yields and capital appreciation.

- Achieve the highest yield by receiving rewards in ANC and have a proportion of your earnings in ANC.

- Capability to choose payout in UST or ANC.

- Defends yield reserve additional.

Lenders also receive enticing incentives such as:

- High and stable deposit yields.

- Option to extract funds promptly.

- Protection of principal due to availability of collateral.

- Utility of aUST as collateral for minting mAssets on the Mirror Protocol.

Borrowers are eligible for incentives as well:

- Borrowing has no interest cost, individuals can earn a net income on the borrowed amount.

- Using UST from borrowing allows the individual to further capitalize on Anchor Protocol.

- ANC that the individual receives allows the borrower governance rights.

Currently, Anchor uses surplus yield to buy back ANC tokens, which tokens get allocated to stakers. Mirror Protocol for example uses fees from minting to buy back MIR tokens, which are then distributed to stakers.

Anchor currently has over $4 billion in collateral in the form of $3.6 billion in bonded LUNA (bLUNA) and $400 million in bonded Ethereum (bETH).

According to Terraform Labs CEO Do Kwon:

“Buyback and burns are de facto deflationary though – it results in 100% of cashback in market buys for each native asset, and results in significant slowdown of money velocity by allocating dividends to people with significantly less propensity to spend. Sufficient slowdown of money velocity is de facto deflationary.”

5. Team & Investors

Do Kwon – CEO Terraform Labs (2019 Forbes 30 Under 30 in Finance and VC category) — Do Kwon is the co-founder & CEO of Terraform Labs. Terra is now 4 years old, based out of Seoul, South Korea, and has created Anchor, Mirror, and Lido (a suite of DeFi price-stable cryptocurrency products directed towards public use to financially help people).

These three products combine to create a one-stop-shop for all your financial needs from investing, savings, and banking. Most of the company’s employees are locally based but they also do employ remote.

Before starting Terra, Do founded a company named Anyfi. Today, they offer a mobile SDK that helps network operators tap into the massive bandwidth locked away in their users’ personal devices to create wireless peer-to-peer wireless networks to provide data communion more efficiently.

Do was a software engineer at Microsoft and Apple, and studied Computer Science at Stanford. Go check out Do Kwon on Twitter and LinkedIn.

On March 16, 2021, Do Kwon tweeted the announcement of Anchor Protocol and announced its investors. Kwon noted that:

“Terra is now in a position where it can be very selective about which investors we choose to work with – and all these investors are expected to add value to Anchor.”

Investors

Prior to Anchor’s launch, it successfully raised $20 million from a handful of notable crypto investment funds, including:

- Galaxy Digital – Founded by Michael Novogratz, Galaxy Digital is a technology-driven financial services and investment management firm that provides institutions and direct clients with a full suite of financial solutions spanning the digital assets ecosystem.

- Alameda Research – Founded by FTX CEO Sam Bankman-Fried and Sam Trabucco, Alameda Research began in October 2017. It currently manages over $1 billion in digital assets and trade $1-10 billion per day across thousands of products: all major coins and altcoins, as well as their derivatives.

- Pantera Capital – Founded by Dan Morehead, since 2013, Pantera has invested in digital assets and blockchain companies, providing investors with the full spectrum of exposure to the space.

- Hashed – Hashed is a team of blockchain experts and builders based in Seoul and Silicon Valley.

- Naval Ravikant – Naval Ravikant is a prolific entrepreneur and investor, having invested in over 200 companies including Uber, Twitter, and Clubhouse.

- Others include: Delphi Digital, Dragonfly Capital Partners, Jump Trading

6. Partnerships

In August 2021, Anchor Protocol announced a partnership with Lido Finance to launch support for bonded Ethereum (bETH). This partnership allows users to reach various applications in the DeFi ecosystem without boundaries. Lido Finance uses staked Ethereum (stETH), which is the strategy to unlock potentials with bETH.

We are thrilled to announce that we are partnering with @LidoFinance to launch bETH (wrapped stETH on @terra_money) — now proposed to be whitelisted as a collateral option on @anchor_protocol! 🚀https://t.co/r4bPdy001W

— Anchor Protocol (@anchor_protocol) August 2, 2021

Find out how to start using bETH in Anchor Protocol by collateralizing. The video below shows how easy it can be!

Another way to start using bETH in Anchor Protocol is by wrapping it. Click on the video below to go step by step into this process.

7. Audits & Security

The highest priority within the Anchor Protocol team is making sure that the protocol is safe and dependable for all users. With the help of Cryptonics and Solidified, two audit companies that have shown tremendous expertise conducted thorough and in-depth analysis on the smart contracts.

The following are the 3 audit reports:

- Audit Report – Anchor Protocol Smart Contracts on March 8, 2021

- Audit Report – Anchor Token and Distributions Smart Contracts on April 6, 2021

- Audit Report – Ethereum Anchor Smart Contracts on July 9, 2021

Along with security audits being conducted, Anchor Protocol has put out a Bug Bounty Program which allows hackers acting in good faith to help keep safety and security top-notch. Anchor Protocol is offering between $500 – $150,000 for bug discoveries within its system. Link to the Bug Bounty Program

*Anchor Protocol exercises caution that even with security audits being done the true assessment of how dependable these smart contracts can be is by size, visibility and time.*

8. Product Roadmap

Anchor plans to expand support to other proof of stake layer 1’s such as Solanas native token SOL. With the utilization and advancement of cross-chain bridges, Anchor is looking at various other major PoS chains to stake derivatives.

Widespread integrations within Anchors API will allow traditional financial platforms and exchanges to capture the masses.

Anchor plans to use direct banking on-ramps to UST deposits by incorporating credit/debit cards and bank wire transfers to an Anchor savings account. Which will give customers better and convivence and allow more money to flow within the protocol.

9. Risks & Opportunities

The main vision of Terraform Labs is to integrate 3 financial products: payments via UST, savings via Anchor and investing via Mirror Protocol.

Being a part of the Terra ecosystem is important for adoption, as its mission is to grow mainstream adoption to decentralized financial services. Terra projects integrate into a one-stop-shop banking system, including stablecoin payments, savings, investing, and crowdfunding.

Traditional bank savings accounts are notorious for abysmal returns. Here are some of the best high yield online savings accounts:

- Live Oak Bank: 0.60% APY

- Vio Bank: 0.57% APY

- Alliant Credit Union: 0.55% APY

- Comenity Direct: 0.55% APY

- Quontic Bank: 0.55% APY

All DeFi protocols all share many of the same risks, but protocols using stablecoins and collateralized debt positions generate additional risks, including:

- Smart contract risk: This is the main reason why audits are so important within these protocols. Eliminating errors and hackers help prevent loss of capital.

- Software risk: Anchor protocol offers a Bug Bounty Program as mentioned above to help prevent malicious attacks from hackers, DDoS attacks, and other suspicious activity.

- Layered risk: With several protocols working together or being built on top of each other, any immoral activity could lead to a damaging chain reaction.

- Regulatory risk: With the constant change of government regulations, possibilities of restrictions within the countries could prevent access into the system.

- Economic risk: Incentives to provide collateral and borrow on other platforms could entice customers to no longer use Anchor Protocol anymore.

10. Conclusion

Anchor Protocol is providing a stable savings solution for the DeFi space. The team’s main objective is to become the gold standard for creating passive income on the blockchain.

Offering easier integrations by offering an open-source code, that can be incorporated using just 10 lines of code to any serviced application holding user balances. This protocol can be used by anyone in the world, there are no minimum deposits, account freezes or sign-up requirements.

By staking returns from multiple PoS blockchains, it allows yields to be stable and attractive to customers planning on investing. The continuous growth and adoption within the DeFi space makes projects likes Anchor Protocol one to keep an eye out for.

Tagged with: BLOCKCHAIN NEWS • crypto news