10 October 2018

Avesoro Resources Inc.

TSX: ASO

AIM: ASO

YOUGA-OUARÉ DRILLING RESULTS AND EXPLORATION UPDATE

Avesoro Resources Inc., (the “Company” or “Avesoro”) is pleased to report an update on exploration activities in Burkina Faso and Liberia. This includes positive drill results from Ouaré, Gassore West, and the discovery of two mineralized vein systems 1.5km east of the Company’s Youga Gold Mine (“Youga”) processing plant.

Avesoro aims to convert 1Moz of existing Mineral Resources into Mineral Reserves from the current year’s 171,000 metre diamond drilling programme. Of this target Ouaré represents 20%, Youga 10%, Balogo 6%, Ndablama 40% and New Liberty 24%.

HIGHLIGHTS

In Burkina Faso the recent focus of drilling has been Ouaré located 35km from the Youga processing plant, and Gassore West located only 2km northeast of the Youga processing plant. In Liberia, recent drilling has included the start of a 10,000m programme at Silver Hills (13km northeast of New Liberty) and some additional drilling at Ndablama (45km from New Liberty) following the completion of the 16,200m drilling programme at Ndablama in July 2018.

BURKINA FASO:

- At Ouaré, 34,500m of the 42,000m planned infill drill programme has now been completed. Several new gold prospects have also been discovered by soil sampling and trenching. Ouaré assay results received to date include:

- BITDDH-18-073 4.15m at 10.8g/t Au from 81m

- BITDDH-18-157 16.15m at 3.94g/t Au from 63m

- BITDDH-18-123 8.15m at 6.51g/t Au from 45m

- At Gassore West a 28,500m drilling programme has been completed and defined three mineralized zones totalling 2km in strike length. Gassore West assay results received to date include:

- GASS-18-291 2.5m at 5.3g/t Au from 71m

- GASS-18-294 3.5m at 5.5g/t Au from 64m

- GASS-18-303 3.6m at 6.0g/t Au from 46m

- Two new vein systems have also been discovered by 20,000m of trenching approximately 1km south of Gassore and directly east of Youga’s historical main pit and waste dump.

LIBERIA:

- At Ndablama 22 holes totalling 4,200m have been completed targeting a high grade shoot. This is in addition to the original 16,200m drilling programme completed in July 2018.

- At Silver Hills 24 holes totalling 3,333m have been completed. The assay result of the first hole SHD001 is 4.5m at 3.72g/t Au from 45.5m.

Serhan Umurhan, Chief Executive Officer of Avesoro Resources, commented “Our 2018 drilling programme continues to deliver excellent results in both Burkina Faso and Liberia. Assay results from Ouaré include a significant number of drill holes with widths and grades exceeding expectations. This bodes well for the grade and gold content of the Ouaré updated Resource and Reserve statement, targeted for early Q1 2019. The exploration team has also discovered two gold vein systems close to Youga’s historical main pit. Although these vein systems are yet to be drilled, the 20,000 metres of trenching has returned very encouraging results whilst the trenching process in the Youga area has historically proven to be a reliable indicator of grade and width.

We remain on track to complete our 171,000 metre drilling programme during 2018, having thus far completed 81,400 metres of diamond drilling in Burkina Faso and 35,600 metres in Liberia as we seek to convert 1Moz of existing Mineral Resources to Reserves”.

BURKINA FASO

OUARÉ INFILL PROGRAMME

Ouaré is located 35km north east of Youga. It has a CIM compliant Indicated Mineral Resource of 5.1Mt grading 1.4g/t (228koz Au) of which 2.67Mt grading 1.67g/t Au (142koz Au) has been declared as a Mineral Reserve. Ouaré also has an Inferred Mineral Resource of 7.2Mt grading 1.8g/t for 406Koz Au.

OUARÉ MINERAL RESOURCE:

|

INDICATED |

INFERRED |

|||||

|

Cut-off (g/t) |

Tonnes (kt) |

Grade (g/t) |

Gold (Koz) |

Tonnes (kt) |

Grade (g/t) |

Gold (Koz) |

|

0.55 |

5.10 |

1.39 |

228 |

7.2 |

1.8 |

406 |

Notes: effective date December, 2017

Ouaré infill drilling was designed to upgrade Inferred material, primarily in the eastern part of the Mineral Resource, to the Measured or Indicated Mineral Resource categories. 34,500m of 42,000m drill programme has been completed to date with seven rigs on site. Results received to date show that the eastern part of the ore body is likely to contain wider and higher-grade mineralisation than the existing Inferred Mineral Resource in that area.

FIG 1. OUARÉ LICENSE MAP:

FIG 2. OUARÉ CROSS SECTION:

OUARÉ DRILL HIGHLIGHTS:

|

From (m) |

To (m) |

Length (m) |

Grade (g/t) |

|

|

BERC-12-048 |

63 |

67 |

4.0 |

5.09 |

|

BITDDH-11-002 |

70 |

100 |

30.0 |

3.22 |

|

BITDDH-11-003 |

88 |

98 |

10.0 |

5.84 |

|

BITDDH-11-005 |

90 |

102 |

12.0 |

4.77 |

|

BITDDH-11-024 |

41 |

51 |

10.5 |

7.14 |

|

BITDDH-12-028 |

113 |

121 |

8.0 |

4.32 |

|

BITDDH-12-030 |

60 |

63 |

3.4 |

12.13 |

|

BITDDH-12-038 |

59 |

64 |

4.9 |

10.34 |

|

BITRC-08-057 |

66 |

68 |

2.0 |

9.37 |

|

BITRC-08-025 |

52 |

54 |

2.0 |

41.60 |

|

BITRC-08-045 |

88 |

98 |

10.0 |

4.41 |

|

BITRC-08-075 |

10 |

38 |

28.0 |

3.81 |

|

BITRC-11-238 |

53 |

59 |

6.0 |

6.65 |

|

BITRC-08-075 |

10 |

38 |

28.0 |

3.81 |

|

BITRC-11-276 |

95 |

106 |

11.0 |

5.17 |

|

BITDDH-18-073 |

81 |

86 |

4.1 |

10.82 |

|

BITDDH-18-123 |

45 |

53 |

8.2 |

6.51 |

|

and |

82 |

91 |

9.4 |

4.82 |

|

BITDDH-18-157 |

63 |

79 |

16.2 |

3.94 |

|

BITDDH-18-061R |

38 |

82 |

44.9 |

4.23 |

|

BITDDH-18-073 |

81 |

86 |

4.1 |

10.82 |

|

BITDDH-18-123 |

45 |

53 |

8.2 |

6.51 |

|

BITDDH-18-158 |

16 |

41 |

25.4 |

3.78 |

Note: It is estimated that true width is approximately 82% of the drilled width stated above

FIG 3. BURKINA FASO LICENSE MAP:

GASSORE WEST DRILLING

At Youga drilling in 2018 has focused on the western strike extension of the existing Gassore East Pit where a maiden CIM compliant Indicated Mineral Resource of 1.2Mt grading 3.89 g/t (150koz Au) and an Inferred Mineral Resource of 0.5Mt grading 4.0 g/t (62koz Au) was announced on June 19th, 2018.

FIG 4. YOUGA LICENSE:

FIG 5. GASSORE AREA AND NEW YOUGA PROSPECTS:

Note: The new Youga prospects have been named West Dump East (WDE) and West Dump East South (WDES)

GASSORE WEST DRILL HIGHLIGHTS:

|

From (m) |

To (m) |

Length (m) |

Grade (g/t) |

|

|

GASS-18-267 |

266 |

272 |

5.9 |

2.65 |

|

GASS-18-267 |

289 |

290 |

0.8 |

40.80 |

|

GASS-18-287 |

29 |

31 |

1.7 |

10.46 |

|

GASS-18-291 |

71 |

74 |

2.6 |

5.27 |

|

GASS-18-294 |

64 |

67 |

3.5 |

5.50 |

|

GASS-18-300 |

196 |

197 |

0.5 |

40.60 |

|

GASS-18-303 |

42 |

44 |

1.4 |

11.13 |

|

GASS-18-303 |

46 |

50 |

3.6 |

6.04 |

|

GASS-18-306 |

94 |

95 |

0.6 |

21.90 |

|

GASS-18-308 |

25 |

26 |

1.0 |

40.10 |

|

GASS-18-310 |

37 |

39 |

1.2 |

15.07 |

|

GASS-18-311 |

83 |

85 |

2.4 |

6.14 |

|

GASS-18-313 |

120 |

121 |

0.6 |

26.20 |

|

GASS-18-315 |

73 |

74 |

0.8 |

25.90 |

|

GASS-18-316 |

63 |

66 |

2.8 |

3.37 |

|

GASS-18-316 |

76 |

77 |

1.1 |

58.10 |

|

GASS-18-318 |

61 |

62 |

0.8 |

17.80 |

Note: It is estimated that true width is approximately 90% of the drilled width stated above

NEW YOUGA PROSPECTS

A 20,000m trenching programme was carried out in an area south of Gassore and east of Youga’s main dump and historical Main Pit. Two parallel structural corridors were defined, characterised by quartz vein related gold mineralisation. The two areas have a combined strike length of 3.8km.

BEST TRENCH RESULTS:

|

Length (m) |

Grade (g/t) |

|

|

WDES_T003 |

24.0 |

1.44 |

|

inc. |

4.0 |

4.36 |

|

WDES_T004 |

1.0 |

10.80 |

|

WDES_T009 |

2.0 |

10.90 |

|

WDES_T014 |

43.0 |

1.46 |

|

inc. |

1.0 |

19.60 |

|

WDES_T016 |

11.0 |

3.00 |

|

inc. |

1.7 |

13.05 |

|

and |

3.0 |

16.70 |

|

WDES_T021 |

1.0 |

14.15 |

LIBERIA

SILVER HILLS DELINEATION DRILLING

Silver Hills is part of a 15km gold-in-soil corridor formed principally by a sheared ultramafic rocks which represents a highly prospective target located 13km northeast of the New Liberty processing plant and regarded as a potential source of feed material. Silver Hills had been surface sampled historically but until now has not been drilled.

The initial Silver Hills drill programme consists of 75 holes totalling 10,000 metres based on an 80×40 drill pattern. The programme is designed to test the 1km long Belgium target, its extent along strike and is expected to produce results sufficient to declare a Maiden Inferred Resource. 24 holes totalling 3,330m have been completed with one assay result from the first hole SHD001 received and returning 4.5m at 3.72g/t Au from 45.5m. The remaining assay results are pending.

FIG 6. SILVER HILLS MAP:

NDABLAMA INFILL PROGRAMME

Ndablama is located 45km from New Liberty and is one of multiple deposits along a 13km gold corridor, delineated through historical exploration work. The Company views Ndablama as a potential source of feed for the New Liberty processing plant. It represents 40% of Management’s 1Moz Mineral Reserve conversion target from the 2018 drilling programme.

In July the Company reported completion of a 75 hole, 16,200m infill drilling programme. The Ndablama drilling was designed to upgrade the classification of Inferred material to the Measured or Indicated Mineral Resource categories. The majority of assays has now been received and are in-line with expectations and available in the Appendix.

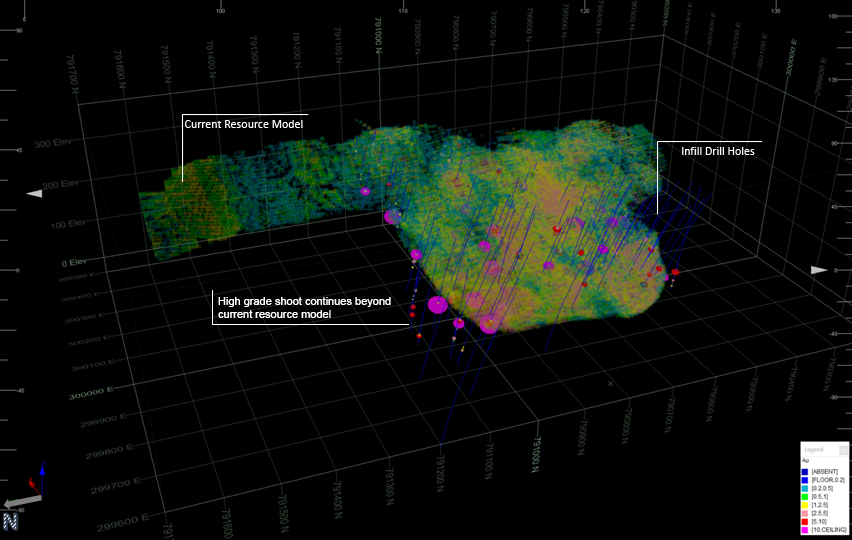

A further 22 holes for 4,200m were approved to test continuity of a high-grade shoot outside the current resource model. Assay results from 13 holes have been received and these confirm the existence of the high-grade shoot within the resource model and its extension outside the model.

An independent Resource update for Ndablama is expected to be completed before end of Q1 2019. A PFS level Ndablama trucking study, which will investigate the viability of hauling material to New Liberty, is underway and due for completion in Q1 2019.

FIG 7. NDABLAMA BLOCK MODEL AND INFILL DRILL TRACES:

NDABLAMA MINERAL RESOURCE:

|

INDICATED |

INFERRED |

|||||

|

Cut-off (g/t) |

Tonnes (kt) |

Grade (g/t) |

Gold (Koz) |

Tonnes (kt) |

Grade (g/t) |

Gold (Koz) |

|

0.5 |

7,589 |

1.6 |

386 |

9,576 |

1.7 |

515 |

|

0.7 |

5,645 |

1.9 |

349 |

6,945 |

2.1 |

464 |

Notes: effective date December, 2017

NDABLAMA DRILL HIGHLIGHTS:

|

From (m) |

To (m) |

Length (m) |

Grade (g/t) |

|

|

NDD121 |

160 |

162 |

2 |

13.47 |

|

NDD126 |

208 |

217 |

9 |

10.26 |

|

inc. |

212 |

216 |

4 |

21.39 |

|

NDD129 |

114 |

135 |

21 |

1.88 |

|

NDD133 |

173 |

220 |

47 |

2.31 |

|

NDD134 |

170 |

194 |

24 |

2.59 |

|

NDD147 |

143 |

180 |

37 |

3.32 |

|

NDD159 |

84 |

128 |

44 |

1.82 |

|

NDD204 |

243 |

256 |

13 |

4.34 |

|

NDD202 |

245 |

267 |

22 |

4.32 |

Note: It is estimated that true width is approximately 90% of the drilled width stated above

NDABLAMA DEVELOPMENT & TRUCKING STUDY

The most likely Ndablama development scenario will involve trucking material to the New Liberty processing plant. A PFS level trucking study is underway which will determine the optimal route based on environmental and social considerations, distance and topography. The study will also estimate capital and operating costs. The current plan is to complete this study before the end of Q1 2019.

FIG 8. LIBERIA LICENSE MAP:

Importantly the Ndablama Gold Corridor sits within the Bea Mountain Mineral Development Agreement (“MDA”) which sets the legal, operational and fiscal parameters that New Liberty operates under, providing for an existing permitting framework for development of these targets.

AVESORO EXPLORATION OVERVIEW

2018 DRILLING AND 1MOZ RESERVE TARGET

Avesoro is undertaking a fully funded 171,000 metres diamond drill programme. Of 139,000 metres planned in Burkina Faso in 2018, 81,400 metres have been completed. Of the 32,000 metres planned for Liberia in 2018, 35,600 metres are complete.

The Company’s target of converting 1Moz from Resource to Reserve is to be based primarily on 2018 infill drilling programmes at New Liberty, Ndablama and Ouaré.

FIG 9. 1MOZ RESERVE TARGET BY PROJECT:

APPENDIX

OUARE DRILL RESULTS:

http://avesoro.com/wp-content/uploads/2018/10/AppendixA.pdf

GASSORE WEST DRILL RESULTS:

http://avesoro.com/wp-content/uploads/2018/10/AppendixB.pdf

NDABLAMA DRILL RESULTS:

http://avesoro.com/wp-content/uploads/2018/10/AppendixC.pdf

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have been deemed inside information for the purposes of Article 7 of Regulation (EU) No 596/2014 until the release of this announcement.

Contact Information

|

Avesoro Resources Inc. Geoff Eyre / Nick Smith Tel: +44(0) 20 3874 4740 |

|

|

Camarco (IR / Financial PR) Gordon Poole / Nick Hennis/ Monique Perks Tel: +44(0) 20 3757 4980 |

finnCap (Nominated Adviser and Joint Broker) Christopher Raggett / Scott Mathieson / Camille Gochez Tel: +44(0) 20 7220 0500 |

|

Berenberg (Joint Broker) Matthew Armitt / Sara MacGrath Tel: +44(0) 20 3207 7800 |

Hannam & Partners (Advisory) LLP (Joint Broker) Rupert Fane / Ingo Hofmaier / Ernest Bell Tel: +44(0) 20 7907 8500 |

About Avesoro Resources Inc.

Avesoro Resources is a West Africa focused gold producer and development company that operates two gold mines across West Africa and is listed on the Toronto Stock Exchange (“TSX”) and the AIM market operated by the London Stock Exchange (“AIM”). The Company’s assets include the New Liberty Gold Mine in Liberia (“New Liberty”) and the Youga Gold Mine in Burkina Faso (“Youga”).

New Liberty has an estimated Proven and Probable Mineral Reserve of 7.4Mt with 717,000 ounces of gold grading 3.03g/t and an estimated Measured and Indicated Mineral Resource of 9.6Mt with 985,000 ounces of gold grading 3.2g/t and an estimated Inferred Mineral Resource of 6.4Mt with 620,000 ounces of gold grading 3.0g/t. The foregoing Mineral Reserve and Mineral Resource estimates and additional information in connection therewith, prepared in accordance with CIM guidelines, is set out in an NI 43-101 compliant Technical Report dated November 1, 2017 and entitled “New Liberty Gold Mine, Bea Mountain Mining Licence Southern Block, Liberia, West Africa” and is available on SEDAR at www.sedar.com.

Youga has an estimated Proven and Probable Mineral Reserve of 11.2Mt with 660,100 ounces of gold grading 1.84g/t and a combined estimated Measured and Indicated Mineral Resource of 16.64Mt with 924,200 ounces of gold grading 1.73g/t and an Inferred Mineral Resource of 13Mt with 685,000 ounces of gold grading 1.70g/t. The foregoing Mineral Reserve and Mineral Resource estimates and additional information in connection therewith, prepared in accordance with CIM guidelines, is set out in an NI 43-101 compliant Technical Report dated effective July 31, 2018 and titled “Mineral Resource and Mineral Reserve Update for the Youga Gold Mine, Burkina Faso” prepared by CSA Global and is available on SEDAR at www.sedar.com.

These technical reports also include relevant information regarding the effective dates and the assumptions, parameters and methods of the Mineral Resource and Reserve estimates cited in this news release, as well as information regarding data verification, exploration procedures, a summary description of the type of analytical or testing procedures utilized, the name and location of each analytical or testing laboratory used, and other matters relevant to the scientific and technical disclosure contained in this news release in respect of the relevant projects.

For more information, please visit www.avesoro.com.

Qualified Persons

The Company’s Qualified Person is Mark J. Pryor, who holds a BSc (Hons) in Geology & Mineralogy from Aberdeen University, United Kingdom and is a Fellow of the Geological Society of London, a Fellow of the Society of Economic Geologists and a registered Professional Natural Scientist (Pr.Sci.Nat) of the South African Council for Natural Scientific Professions. Mark Pryor is an independent technical consultant with over 25 years of global experience in exploration, mining and mine development and is a “Qualified Person” as defined in National Instrument 43 -101 “Standards of Disclosure for Mineral Projects” of the Canadian Securities Administrators and has reviewed and approved this press release. Mr. Pryor has verified the underlying technical data disclosed in this press release.

Forward Looking Statements

Certain information contained in this press release constitutes forward looking information or forward looking statements within the meaning of applicable securities laws. This information or statements may relate to future events, facts, or circumstances or the Company’s future financial or operating performance or other future events or circumstances. All information other than historical fact is forward looking information and involves known and unknown risks, uncertainties and other factors which may cause the actual results or performance to be materially different from any future results, performance, events or circumstances expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “would”, “project”, “should”, “believe”, “target”, “predict” and “potential”. No assurance can be given that this information will prove to be correct and such forward looking information included in this press release should not be unduly relied upon. Forward looking information and statements speak only as of the date of this press release.

Forward looking statements or information in this press release include, among other things, statements regarding the targeted conversion of 1Moz of Mineral Resources into Mineral Reserves, increasing the classification of the existing Mineral Resource at Ndablama to higher levels of confidence, completion of an independent Resource update for Ndablama before end of Q1 2019 and a PFS level Ndablama trucking study in Q1 2019,

In making the forward looking information or statements contained in this press release, assumptions have been made regarding, among other things: general business, economic and mining industry conditions; interest rates and foreign exchange rates; the continuing accuracy of Mineral Resource and Reserve estimates; geological and metallurgical conditions (including with respect to the size, grade and recoverability of Mineral Resources and Reserves) and cost estimates on which the Mineral Resource and Reserve estimates are based; the supply and demand for commodities and precious and base metals and the level and volatility of the prices of gold; market competition; the ability of the Company to raise sufficient funds from capital markets and/or debt to meet its future obligations and planned activities and that unforeseen events do not impact the ability of the Company to use existing funds to fund future plans and projects as currently contemplated; the stability and predictability of the political environments and legal and regulatory frameworks including with respect to, among other things, the ability of the Company to obtain, maintain, renew and/or extend required permits, licences, authorizations and/or approvals from the appropriate regulatory authorities; that contractual counterparties perform as agreed; and the ability of the Company to continue to obtain qualified staff and equipment in a timely and cost-efficient manner to meet its demand.

Actual results could differ materially from those anticipated in the forward looking information or statements contained in this press release as a result of risks and uncertainties (both foreseen and unforeseen), and should not be read as guarantees of future performance or results, and will not necessarily be accurate indicators of whether or not such results will be achieved. These risks and uncertainties include the risks normally incidental to exploration and development of mineral projects and the conduct of mining operations (including exploration failure, cost overruns or increases, and operational difficulties resulting from plant or equipment failure, among others); the inability of the Company to obtain required financing when needed and/or on acceptable terms or at all; risks related to operating in West Africa, including potentially more limited infrastructure and/or less developed legal and regulatory regimes; health risks associated with the mining workforce in West Africa; risks related to the Company’s title to its mineral properties; the risk of adverse changes in commodity prices; the risk that the Company’s exploration for and development of mineral deposits may not be successful; the inability of the Company to obtain, maintain, renew and/or extend required licences, permits, authorizations and/or approvals from the appropriate regulatory authorities and other risks relating to the legal and regulatory frameworks in jurisdictions where the Company operates, including adverse or arbitrary changes in applicable laws or regulations or in their enforcement; competitive conditions in the mineral exploration and mining industry; risks related to obtaining insurance or adequate levels of insurance for the Company’s operations; that Mineral Resource and Reserve estimates are only estimates and actual metal produced may be less than estimated in a Mineral Resource or Reserve estimate; the risk that the Company will be unable to delineate additional Mineral Resources; risks related to environmental regulations and cost of compliance, as well as costs associated with possible breaches of such regulations; uncertainties in the interpretation of results from drilling; risks related to the tax residency of the Company; the possibility that future exploration, development or mining results will not be consistent with expectations; the risk of delays in construction resulting from, among others, the failure to obtain materials in a timely manner or on a delayed schedule; inflation pressures which may increase the cost of production or of consumables beyond what is estimated in studies and forecasts; changes in exchange and interest rates; risks related to the activities of artisanal miners, whose activities could delay or hinder exploration or mining operations; the risk that third parties to contracts may not perform as contracted or may breach their agreements; the risk that plant, equipment or labour may not be available at a reasonable cost or at all, or cease to be available, or in the case of labour, may undertake strike or other labour actions; the inability to attract and retain key management and personnel; and the risk of political uncertainty, terrorism, civil strife, or war in the jurisdictions in which the Company operates, or in neighbouring jurisdictions which could impact on the Company’s exploration, development and operating activities.

Although the forward-looking statements contained in this press release are based upon what management believes are reasonable assumptions, the Company cannot provide assurance that actual results or performance will be consistent with these forward-looking statements. The forward looking information and statements included in this press release are expressly qualified by this cautionary statement and are made only as of the date of this press release. The Company does not undertake any obligation to publicly update or revise any forward looking information except as required by applicable securities laws.

Source

Tagged with: CURRENT GOLD PRICE • GOLD PRICE INVESTMENT • MAKE MONEY GOLD • PRECIOUS METALS