Uniswap (UNI) has become the first decentralized finance (DeFi) trading platform to generate over $100 billion in volume, the protocol’s founder Hayden Adams announced today.

🦄 @Uniswap just became the first decentralized trading platform to process over $100b in volume – an exciting milestone for DeFi 🚀 pic.twitter.com/hUoM36aG6A

— Hayden Adams 🦄 (@haydenzadams) February 15, 2021

“Uniswap just became the first decentralized trading platform to process over $100b in volume – an exciting milestone for DeFi,” Adams tweeted.

This milestone is a logical continuation of the “DeFi boom” that began last summer. As CryptoSlate reported, Uniswap’s rise to prominence ultimately led to the platform slowly eclipsing Coinbase and other centralized trading platforms in early September.

“Second day in a row where Uniswap volume > Coinbase. This month, multiple DEXes like Curve, 1inch, Balancer, also have volume on par with big exchanges like Kraken, Bitstamp, Gemini, etc. Most of these CEXs have multi-billion valuations. ETH is still sub-50B mktcap,” pseudonymous trader CL noted at the time.

Second day in a row where Uniswap volume > Coinbase.

This month, multiple DEXes like Curve, 1inch, Balancer, also have volume on par with big exchanges like Kraken, Bitstamp, Gemini, etc.

Most of these CEXs have multi billion valuations.

ETH is still sub 50B mktcap.

— CL (@CL207) August 31, 2020

Notably, Uniswap’s monthly trading volume reached $20 billion in January alone, clearly demonstrating the exponential growth of the sector. For comparison, the platform’s daily volume has already surged to over $1.14 billion today, data provided by crypto metrics platform CoinGecko shows.

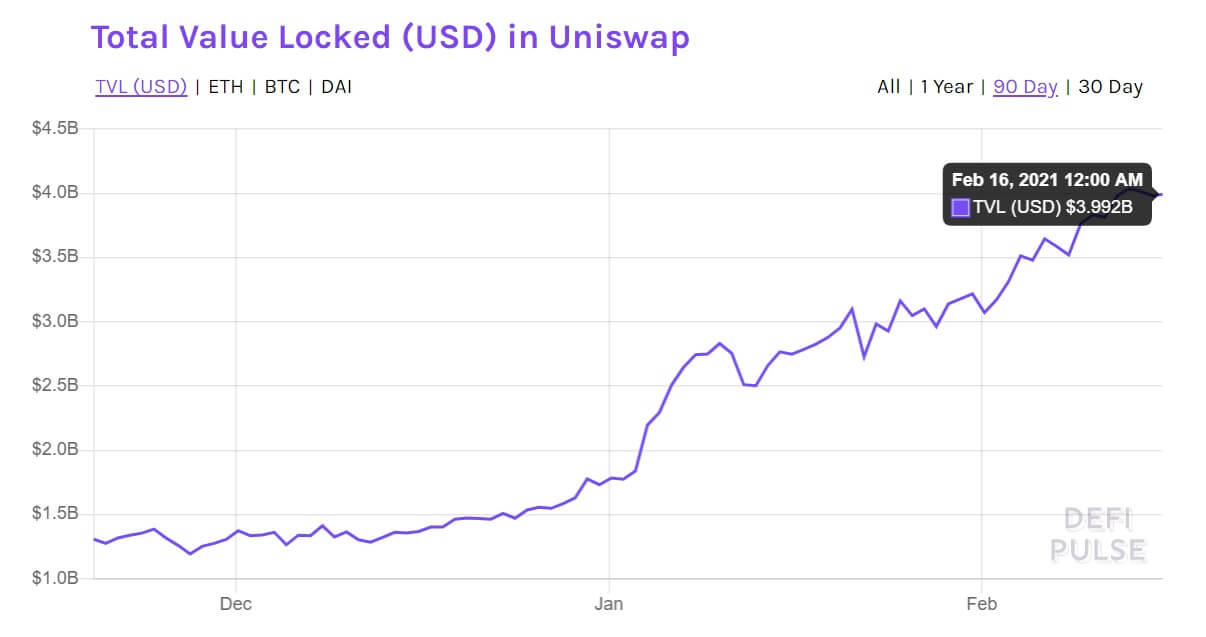

At press time, the total dollar value locked in Uniswap amounted to roughly $4 billion, according to DeFi Pulse.

However, while Uniswap is one of DeFi’s top dogs today, its competitors are swiftly catching up. For example, the Binance Smart Chain (BSC) ecosystem is currently on the fast track to outpace Ethereum in terms of volumes as one decentralized application (dapp)—algorithmic money market protocol Venus—has generated $14 billion in transaction volume last month, according to a recent report by DappRadar.

“Venus has become the biggest dapp on BSC in January with $14 billion in transaction volumes. Venus positioned itself in the number one position in terms of transaction volume, thanks to more than $24 billion in the last 7 days,” the researchers wrote on February 11.

Today, Venus’s daily volume has already exceeded $10 billion. That’s some serious competition.