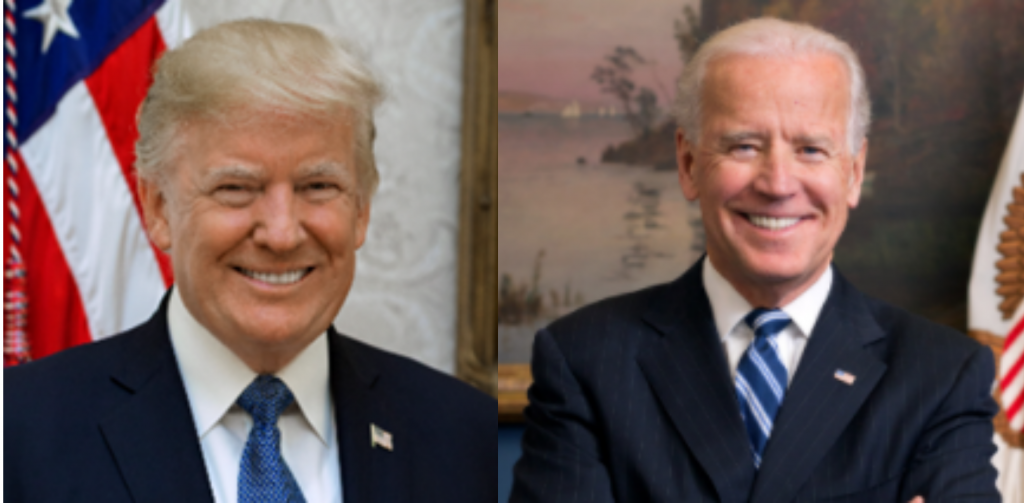

Ignore the noise of the Trump or Biden Presidency and focus on the dollar and gold’s fundamentals

Election day 2020 on November 3rd is now only a matter of days away.

The Trump versus Biden battle has been and will in the final days, continue to be one of the most viciously fought elections in American history.

Markets continue to weigh-up the impact of each man’s Presidency on assets including stocks, bonds, the US dollar and gold.

The outcome is still in the balance and there are many potential election outcomes and potential political and economic ramifications. Some of the outcomes of the election include:

- An undisputed Biden win by a narrow margin

- An undisputed Biden win by a large margin

- An undisputed Trump win by a narrow margin

- An undisputed Trump win by a large margin

- Biden wins by a large or more likely a narrow margin but the outcome is disputed

- Trump wins by a large or more likely a narrow margin but the outcome is disputed

Alas, given the extremely partisan, acrimonious and near civil war style politics and the claims regarding voting fraud, partisan media etc, it looks increasingly like it will be a disputed election, which sees neither candidate secure a clear mandate from the American people.

In many ways, this may be the worst outcome for the U.S. politically and economically and indeed for many financial assets like stocks and bonds which value certainty and stability. Conversely, this uncertainty has benefited gold in recent months and years (see chart below) and would be expected to continue to do so.

It is important to keep in mind and realise that while the extremely divided and volatile political landscape of America is a factor worth considering when evaluating the outlook for gold, at the same time it is just one factor and some would say it is a relatively small factor whose implications are likely to be short-term in nature rather than long-term.

Far more important to the medium and long-term outlooks for gold are the global supply and demand fundamentals in the mining and the “above ground” physical gold market and the heightened macroeconomic, monetary, systemic and geopolitical risks in the world today.

In recent months, these risks have been exacerbated by the coronavirus crisis and the subsequent lockdowns which have made gold even more attractive to risk averse investors and gold bullion buyers and propelled gold prices higher in 2020. The top performing asset in the world (see Thomson Reuters table below) in 2020 with gains of 25% in dollar terms is gold, while ‘poor man’s gold’ – silver is up 35%.

Having said that, it is worth giving some consideration to the impact each man’s election might have on an increasingly vulnerable U.S. and what those impacts might be financially, economically, monetarily and politically.

Financial and Economic Outlook and Risks

The Democrats were in decades past seen as the party of ‘tax and spend’ although this distinction has been far less pronounced in the modern era. Biden is more likely to engage in tax and spend style economic policies in a desperate attempt to maintain economic growth and prevent a U.S. recession or depression.

Biden would be likely to tax more and spend more. Trump’s inclination would be to reduce taxes again, but he may struggle to do so given the already massive $3 trillion plus U.S. budget deficit.

The difference between the two men in this regard might be more about how and who they tax and what they spend their budgets on.

Trump would be expected to favour American corporations that employ American workers while Biden, like Obama, would have a more globalist view and would be expected to favour multinational corporations and banks. This is somewhat simplistic but largely true, nonetheless.

Monetary Outlook and Risks to the Dollar

Both men will almost certainly tax, spend and continue to allow the dollar to be debased with the electronic creation of trillions and trillion of new digital dollars by the Federal Reserve.

There is a strong likelihood of a severe U.S. recession and a global recession in the coming months. There will be less economic activity and economic stagnation and contraction and therefore less taxes are likely to be generated.

The U.S. Federal Budget Deficit has surged to $3.15 trillion for 2020 alone which has seen the U.S. national debt surge to over $27 trillion.

Both Trump or Biden will likely work with the Federal Reserve and allow them to digitally create trillions more dollars in order to bail out Wall Street banks, corporations and the financial system – QE is now being used to buy exchange traded funds and even junk bonds in order to prevent assets from crashing.

In the process, they are quietly and surreptitiously devaluing the reserve currency of the world and inflating away the huge debts owed to their many creditors including their largest creditor China.

Currency debasement has been happening slowly but surely since Nixon went off the Gold Standard in 1971. It began to accelerate under George W. “Dubya” Bush after September 11th and again under Obama after Lehman Brothers and the near global financial collapse from 2008 to 2011. While the creation of currency is the remit of America’s central bank which is meant to be independent, the Presidents in recent years have tacitly endorsed the ultra-loose monetary policies and currency debasement of Fed governors including Greenspan, Bernanke, Yellen and now Powell.

The Fed works hand in glove with Wall Street and its leading banks and tends to have their financial interests at heart, rather than those of Main Street and entrepreneurial and working America.

Trump identified this in his election campaign in 2016 and it was one of the reasons that he was popular and elected. He voiced a concern that many have about central banks like the Federal Reserve. He said he would be more fiscally prudent and would seek the central bank to be more conservative monetarily. This they have not been and indeed their policies are looser now than they have ever been.

Trump’s base hope that he may attempt to reform the Federal Reserve in a second term, and this remains possible.

It is important to remember the historical context here. America was in a poor financial and monetary state when Trump was elected in 2016 with the National Debt having risen to $19.9 trillion. By the start of this year, the national debt had surged to nearly $24 trillion – a rise of roughly $1 trillion a year for every year of the President Trump’s first term. As a result, Trump repeated the roughly $1 trillion a year increase in debt as seen in the previous Bush and Obama Presidencies. Something he had promised not to do, running as he did on a ticket of fiscal and economic prudence.

The advent of the coronavirus crisis and the subsequent lockdowns and economic shutdowns have exacerbated this trend and seen the U.S. national debt surge to over $27 trillion. It is increasing every month very rapidly as debt is piled upon debt it will likely surpass $30 trillion by early 2021.

Meanwhile, there is also the not insignificant matter of the between $100 trillion and $150 trillion in unfunded liabilities – for Medicare, Medicaid and social security as the “Baby Boomers” begin to retire.

The U.S., like the UK, the EU and most nations today, is “kicking the can down the road.” Consequently, a U.S. and global debt crisis looks likely during the term of the next President.

The sharply deteriorating financial and economic position of the U.S. imperils America’s status as the global hegemon and the dollar’s increasingly tenuous status as the reserve currency of the world. This is of far more importance than the outcome of the Presidential election and whether there is a President Biden or a President Trump for a second term. Either man will face this challenge and a likely dollar crisis, an international monetary crisis and a currency reset which sees gold revalued to $5,000 per ounce or much more.

Societally and Politically – Deepening Civil War Politics and Risk to Democracy

A disputed election will exacerbate the existing highly partisan and brutal civil war style politics which will see more civil unrest and could result in an actual modern-day civil war. America has never been so divided – between red and blue, men and women, black and white, rich and poor and these political, gender, ethnic and socio-economic divisions are not going away anytime soon. These divisions are already seeing a rise in violence.

In a worst-case scenario, there could be violence between supporters of Trump and Biden – including by different factions in intelligence agencies, the police and the military.

This acrimony and division also threaten American democracy as the incumbent may decide to suspend the democratic process for a period of time and concentrate and exercise power in the Executive. Thus, wielding power in an increasingly dictatorial style via intelligence agencies, police forces and the military. Rightly or wrongly this a real fear on both sides but even more so by Democratic supporters who already accuse Trump of being a fascist and being akin to a dictator.

Even the most partisan Republican or Democrat supporters or indeed Trump or Biden supporters would have to admit that America, an Empire in all but name, is heading in an increasingly fascist direction with increasing powers in the hands of the White House incumbent. This is a long-term historical trend which sped up with the advent of the so-called “War on Terror” and the trend has continued and indeed deepened in recent years.

Wall Street Versus Main Street – Different Sections of Corporate America to Benefit

Mussolini said that fascism “should more appropriately be called corporatism because it is a merger of state and corporate power.” In many people’s view America has been captured by its corporations and by corporatism. Free markets are increasingly a thing of the past, there is less and less competition and the state is being run for the benefit, not of “Main Street” and the man on the street, but for the benefit of the largest corporations, banks and the ultra wealthy billionaire elites – the 0.1%.

Trump had pledged prior to being elected that he would challenge this and be a champion of “Main Street” and the working and middle classes and indeed small and medium size business. He has made some strides in this regard but not to the degree that his supporters had hoped he would.

In my view, the differences between the candidates is exaggerated. While they are very different men and their styles are very different, both are candidates beholden to different sections of corporate America.

Trump’s base is ‘heartland’ American corporations and small and medium size companies that engage in manufacturing, agriculture, mining, oil and gas, railways and transport, construction and what could broadly be called old world industry and the entrepreneurs, business people and workers in those industries.

Biden would be favoured by many of the largest American multinational corporations and banks including large sections of big tech in Silicon Valley, the largest American law firms, Hollywood and much of the entertainment industry, hedge funds and billionaires with a more socially liberal and globalist world view and of course by Wall Street banks. Biden’s base is Wall Street and the financial sector, big tech corporations and federal workers.

Their respective allegiances are seen in their policies and proposed policies and indeed in the massive donations made particularly to Biden who has had record donations but also to Trump. In the event of their election, each man would favour their respective sectors and their respective funders and backers.

Conclusion

It is nigh impossible to predict how gold will react to different election outcomes as there are so many variables and uncertainties in the pandemic lockdown world of today.

It is worth remembering that frequently over the years we have seen many counter intuitive price reactions when gold prices moved the opposite way most analysts and investors had expected. Indeed, the now proven manipulation of the gold market via gold futures makes it even more difficult to try and gauge the short-term impact of the election on gold prices. Large institutional players –private and official – can impact gold prices significantly in the short term.

We simply do not know and cannot say what impact the election will have on gold in the short term.

What we can say is that the existing fundamentals of the gold market are very sound indeed and the dollar and all fiat currencies are set to be devalued in the coming years (see gold’s performance table above), as they have been in the last 50 years.

Both gold and silver bullion will continue to rise in value as currencies are devalued and will act as important safe haven assets which will hedge the many political, economic and monetary risks of 2020 and the coming decade.

NEWS and COMMENTARY

Dollar slips and yuan soars as investors eye Biden presidency

Global shares advance on stimulus, Biden victory hopes

U.S. Budget Gap Tripled in Fiscal 2020 as Government Battled Pandemic

Gold gains as easing dollar, U.S. stimulus hopes bolster appeal (Reuters)

WGC says gold ETFs add 1,000t in 2020

GOLD PRICES (USD, GBP & EUR – AM/ PM LBMA Fix)

08-Oct-20 1891.35 1887.45 1460.12 1460.70 1608.03 1607.73

07-Oct-20 1888.00 1884.50 1464.33 1463.69 1605.56 1601.83

06-Oct-20 1912.50 1913.40 1472.82 1476.00 1623.33 1623.90

05-Oct-20 1899.65 1909.60 1467.48 1472.49 1616.41 1620.49

02-Oct-20 1906.40 1903.05 1473.46 1471.82 1627.87 1624.44

01-Oct-20 1895.55 1902.00 1477.01 1476.33 1615.96 1619.74

30-Sep-20 1883.40 1886.90 1468.49 1467.63 1609.74 1613.30

29-Sep-20 1882.40 1883.95 1461.87 1465.71 1610.02 1606.44

28-Sep-20 1850.95 1864.30 1440.78 1448.37 1589.41 1597.52

25-Sep-20 1870.05 1859.70 1467.05 1462.65 1605.25 1598.78

24-Sep-20 1850.75 1861.75 1453.21 1460.92 1588.68 1598.50

23-Sep-20 1888.10 1873.40 1483.48 1470.06 1611.49 1603.63

22-Sep-20 1903.10 1906.00 1487.46 1493.16 1621.63 1625.25

21-Sep-20 1930.90 1909.35 1503.21 1489.48 1638.18 1624.47

18-Sep-20 1954.75 1950.85 1505.16 1508.01 1647.85 1648.66

17-Sep-20 1936.10 1936.25 1494.67 1499.82 1642.78 1640.20

16-Sep-20 1964.80 1961.80 1521.15 1512.55 1654.56 1656.74

15-Sep-20 1963.55 1949.35 1523.13 1513.09 1652.13 1644.67

Buy gold coins and bars and store them in the safest vaults in Zurich, Switzerland with GoldCore.

Learn why Switzerland remains a safe-haven jurisdiction for owning precious metals. Access Our Most Popular Guide, the Essential Guide to Storing Gold in Switzerland here

Receive Our Award Winning Market Updates In Your Inbox – Sign Up Here

Tagged with: CURRENT GOLD PRICE • GOLD PRICE INVESTMENT • MAKE MONEY GOLD • MAKE MONEY SILVER