Non-fungible tokens: The latest trend in the crypto world that’s got big brands like Nike, NBA, Formula 1, Louis Vuitton and more, taking notice and getting involved. They’re moving hundreds of thousands of dollars and projects are reaching record-breaking sales. Just a few months ago, records were in the 5 to 6 digit figures, such as the Bitcoin-code-inspired artwork that sold for over $130,000 or the blockchain-based trading card of Paris Saint-Germain forward Kylian Mbappé that sold for $66,850.

Meanwhile, those records have been shattered by the recent auction of Twitter CEO Jack Dorsey’s first ever tweet, with a current highest bid at $2.5M (the auction ends on March 21st), and even more mind-blowing: the sale of a single digital artwork for $69M. But more than what many consider pure speculation, NFTs are tapping into the passions of the masses and onboarding them into the blockchain world through channels of entertainment and recreation. They’re making it easier for beginners to access and understand the value that blockchain technology and decentralization can provide to them.

Commonly referred to as NFTs, non-fungible tokens represent tokenized versions of non-fungible assets, digital or otherwise. Non-fungible assets have unique properties and attributes that make them rare, indivisible and valuable. These assets can range from virtual collectibles, game items and digital artwork, to concert tickets, real estate, identity documents, and more. The current crypto market revolves heavily around fungible assets like bitcoin and other cryptocurrencies.

But NFTs are gaining traction and their rise in popularity is opening a wide range of possibilities for real-world and virtual assets. Current NFT use cases are concentrated in the main categories of collectibles, art, gaming and virtual worlds. But other categories like sports, fashion and real-world assets are steadily developing.

An interesting twitter thread by virtual land investor @Dclblogger lists about 25 industries that the NFT ecosystem is disrupting. But here are the current big five NFT use cases: collectibles, gaming, art, virtual worlds, and real-world assets and documentation. Which use case captures your interest most and what value can it offer you?

1. Collectibles

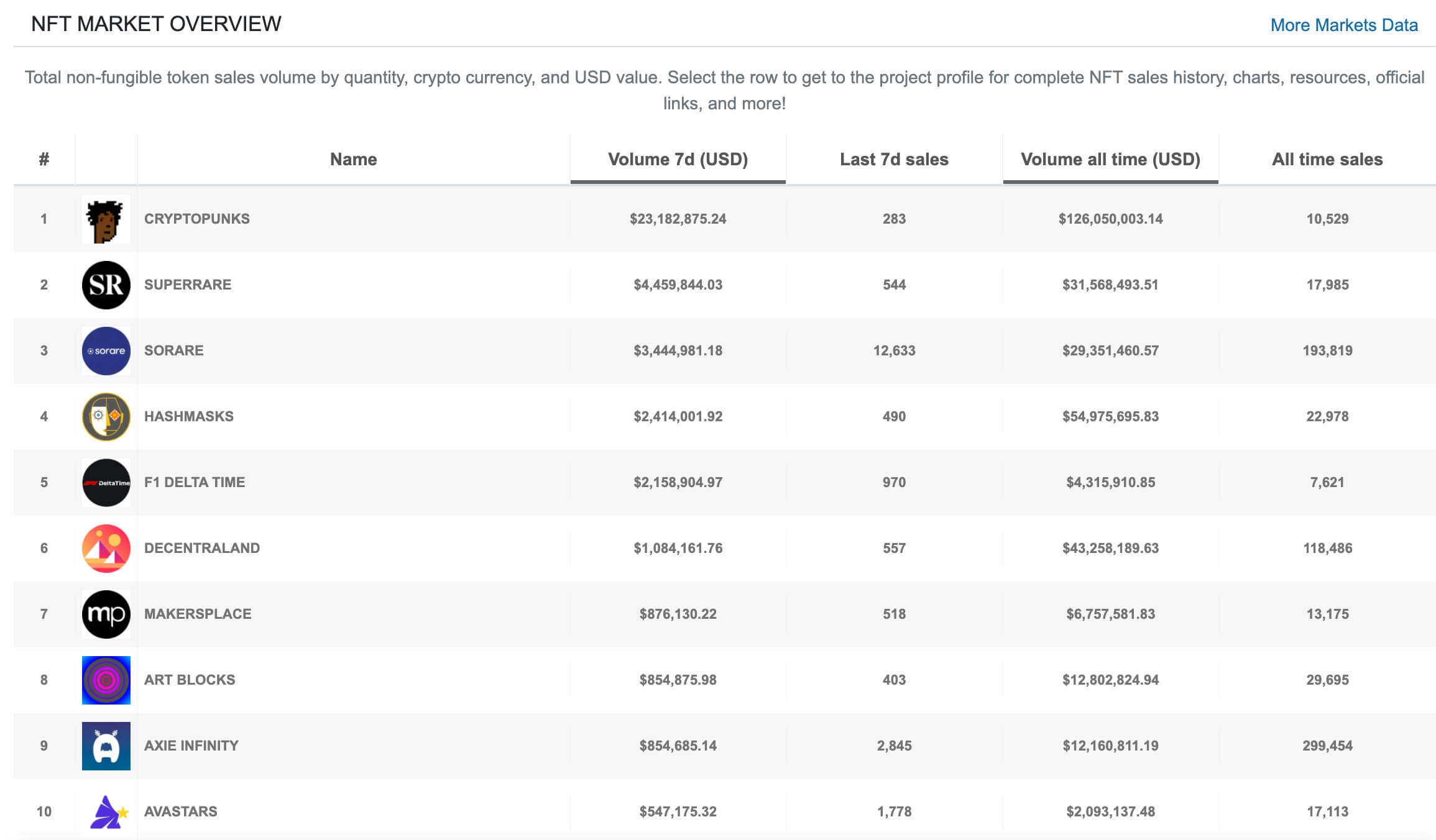

Collectibles are currently one of the most popular applications of NFTs in terms of sales volume, with around 23.6% of the past month’s sales coming from collectible-related projects. CryptoPunks, launched in June 2017, are one of the first collectible NFTs on Ethereum and have sold for thousands of dollars. They were actually developed prior to the introduction of ERC-721 and a wrapper had to be introduced so they could be traded on exchanges like OpenSea. Since their launch in November 2017, CryptoKitties remain one of the most notorious examples of collectibles and sales for the virtual cats have reached an all-time volume of over $38 million.

This category continues to develop and expand as NFT technology is being leveraged to create tokenized versions of star athletes and celebrities for fans to collect. The fantasy soccer game Sorare allows players to collect “limited edition digital collectibles” of their favorite athletes from 100 football clubs.

Members of the NFL and NBA expressed interest in working with NFT technology during the NFT NYC back in February 2020. Since then, in partnership with the NBA, CryptoKitties creators Dapper Labs have launched token-powered NBA TopShot.

In conversation with Cointelegraph, Dapper Labs’ head of partnerships and marketing, Caty Tedman, stated that:

“The product is meant to give fans a piece of ownership over the action that happens on court.”

By tapping into passionate fan bases, NFT collectibles have demonstrated their potential and power to bring these communities to blockchain. NFTs are also dragging more traditional collector items into blockchain technology, such as trading cards, coins and stamps (e.g. crypto stamps).

The digital collectible ecosystem Terra Virtua stands at the forefront of the NFT collectibles movement. The platform aims to provide users with a “deep sensory experience” by taking digital collectibles into a multiplatform VR and AR world. Terra Virtua has launched a collection of character-based 3D animated creatures called ‘vFlects’ along with licensed collectibles in 2D and 3D from The Godfather, Top Gun, Sunset Boulevard and Lost in Space.

They offer a marketplace for an interactive range of unique and licensed digital collectibles, but have also launched an ecosystem through their art gallery app and Terra Virtua Fancave to create a cross-platform journey.

The art gallery app allows owners to store, display, interact with and show off their collection of unique digital artworks. The Terra Virtua Fancave is a personalized and customizable VR environment where users can display their collectibles. Gary Bracey (CEO at Terra Virtua) says:

“The key mission of Terra Virtua is to bring NFTs to the mass-market. The videogame experience of the core team gives us a strong focus on UX and UI and by making the process both frictionless and compelling we hope to bring the world of interactive Digital Collectibles to the mainstream.”

The sensory element and cross-platform capabilities that Terra Virtua provides its users pushes NFTs beyond their current label as products into truly engaging and interactive experiences.

2. Gaming

As mentioned earlier, gamers make the perfect target market for NFTs since they’re already familiar with the concept of virtual worlds and currencies. NFTs are booming within the gaming industry as they allow in-game items to be tokenized and easily transferred or exchanged with peer-to-peer trading and marketplaces.

This is quite unlike traditional games that prohibit the sale or transfer of in-game items like rare weapons and skins. NFTs also make the gaming experience more tangible and rewarding as players have true ownership over their digital assets. They are also creating a new economy as players now have the potential to earn money by building and developing their in-game assets.

“The crux of blockchain’s potential here is the theory that player loyalty will increase when they have more skin in the game: when their digital assets can be transferred between games or platforms, or traded on open markets, they will invest more of their hard-earned cash.” (Source: Cointelegraph)

A Galaxy Interactive pamphlet explains that virtual goods earn the same status as their physical counterparts:

The value we create inside of our virtual worlds will become indistinguishable from the value we’ve historically created outside of them.“

NFT incorporation into the gaming world is also encouraging the development of an engaging and interactive community as players begin to build an inherent community aspect through peer-to-peer trading.

Three popular blockchain games that have really taken off are Axie Infinity, Gods Unchained and My Crypto Heroes. Axie Infinity is a digital pet community centered around collecting, training, raising and battling fantasy creatures called Axie. The game is built on the Ethereum blockchain and is the first game on the blockchain to feature animated characters and rich, immersive gameplay.

Gods Unchained is a digital collectible card game where cards are issued as NFTs and players can own and trade them with the same level of ownership as physical cards. My Crypto Heroes is a Japanese multiplayer role-playing battle game that issues heroes and in-game items as tokens on the Ethereum blockchain, where players can level up historical heroes through quests and tournaments.

3. Art

One of the biggest challenges for digital artists is protecting their creations against copyright infringement, but NFTs are a solution as they provide proof of ownership, authenticity and eliminate issues of counterfeiting and fraud. An article from CoinDesk notes that many artists have turned to NFTs and online showrooms as museums and galleries are forced to close in the face of COVID-19, and “Just as Bitcoin paved the way for trustless, peer-to-peer transactions by creating a shared ledger of events, crypto art […] has provenance built in.”

The first record for the highest-valued NFT art auction sale occurred in July, when “Picasso’s Bull” was purchased for over $55,000. Other subsequent records include “Right Place & Right Time” (sold for over $100,000) and “Portraits of a Mind” (sold for over $130,000). Cointelegraph points out that:

“These projects can even improve and streamline artists’ revenue by connecting them directly to consumers through blockchain-based payment and exchange solutions.”

Examples of platforms and marketplaces for digital artwork include SuperRare, MakersPlace and Rarible. These platforms and marketplaces operate similarly to one another and allow users to easily create original digital artworks and sell it on their marketplace. Rarible is a particularly interesting example as it brings together some of the more interesting DeFi trends of 2020 by combining digital collectibles with yield farming and liquidity mining. They’ve accomplished this by issuing their governance token $RARI.

This adoption strategy has been one of the reasons for the renewed interest in NFTs during the last few months of 2020. Users are rewarded and incentivized with Rarible’s governance token ($RARI) when they sell and trade their NFTs on the platform. As such, Rarible is a community-governed marketplace aimed at becoming a fully Decentralized.

Autonomous Organization (DAO) and the $RARI token is the first step in that direction. Besides Rarible, many other platforms and NFT marketplaces have also started issuing and distributing governance tokens: The Sandbox ($SAND), Somnium Space ($CUBES), Decentraland ($MANA), a full list can be found on CoinGecko.

4. Virtual worlds

Another use case for NFTs is virtual worlds. Decentralized virtual reality platforms like Decentraland, The Sandbox and Cryptovoxels allow users to create, own and monetize parcels of virtual land and other in-game NFT items. LAND in Decentraland is permanently owned by the community and gives players full control over their creations and virtual assets.

Considering Gen Z’s familiarity with virtual worlds and how their concept of valuable assets differs from older generations, assets in virtual worlds give them choice and flexibility that aligns with their values: “So perhaps our children’s generation won’t own the roof over their heads, but they’ll own a wealth of digital assets instead.”

5. Real-world assets and documentation

It’s possible to tokenize real-world assets like property and shares or documentation such as qualifications, licenses, medical histories, birth and death certificates. However, developments in this category are still at an early stage and its use cases are relatively rare.

But as the crypto world and NFTs continue to develop and expand, who’s to say you won’t one day (maybe soon) be able to own a plot of vineyard in another country thousands of miles away. For all we know, your digital wallet – and perhaps ideally a hardware wallet such as NGRAVE ZERO – may soon contain proof of every certificate, license and asset you own.

Explore all NFT coins on CryptoSlate.

Guest post by Ruben Merre from NGRAVE

Ruben Merre is the CEO and founder of NGRAVE. NGRAVE is a crypto hardware wallet company which purports to offer the most secure solution on the planet with its fully offline hardware wallet, NGRAVE ZERO.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

Real-time charts

Price snapshots

More context