Bitcoin bounces at $30k support to allay fears of a complete capitulation. Nonetheless, the 30% drop from last Friday’s high was a real wake-up call for investors.

More so for the over-leveraged longs who, to their detriment, chose to ignore the warning signs.

As much as recent weeks have been a boon for hodlers, yesterday’s dip showed just how unforgiving Bitcoin can be.

While the extreme volatility gave incentive for diehard skeptics to attack, the overall narrative that Bitcoin is a legitimate investment remains intact.

After all, only the most blinkered can deny the significance of Bitcoin’s 330% growth over the last 12 months. Or the fact that it was the best-performing asset of the outgoing decade, and by a significant margin too.

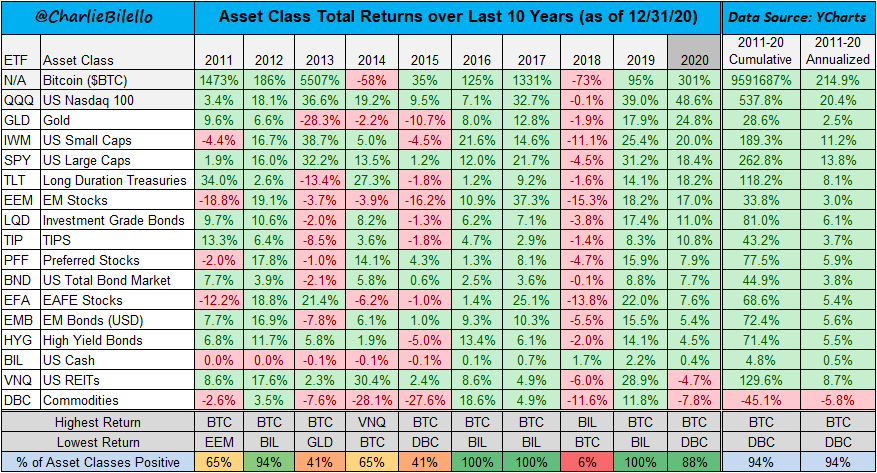

Data compiled by the Founder and CEO of Compound Capital Advisors, Charlie Biello, shows, BTC had cumulative growth of close to 1,000,000% over the last ten years. A staggering rate in anyone’s books.

Over the same period, as the second-best performing, the Nasdaq posted a healthy, if somewhat incomparable, 538%.

While there remains no shortage of critics, some of those diehard skeptics are now waking up to the numbers, which more than sell themself.

Although mainstream acceptance is not here yet, some of those critics are beginning to reassess their position concerning Bitcoin.

One such individual is investment strategist Edward Chancellor.

While Chancellor remains far from being a maxi, he admits he may have been totally wrong about Bitcoin.

Bitcoin is changing hearts and minds

Chancellor’s article, titled “Breakingviews – Chancellor: Was I totally wrong about bitcoin?” opens with a summing up of the start of crypto winter.

“The cryptocurrency wasn’t money, but instead resembled the gold prospector’s fabled sardine tin: “good for trading but not for eating.”

The occasional references to bubbles and “speculative fervor,” indicate he remains less than sold on the Bitcoin concept.

But despite that, Chancellor accepts there is something to be said about its stickability over the booms and busts.

“Having survived several bubbles and busts over the past decade, bitcoin has shown itself to be remarkably durable. Bubbles are great marketing tools: just about everyone on earth now knows about the bitcoin brand. In a world where network effects are all-powerful, this free publicity gives the best-known crypto a huge advantage over rivals.”

With that, Chancellor clings staunchly to his initial 2017 bubble call. But he concedes that, if history is to repeat, Bitcoin is only growing stronger over time.

Which, coming from an old school economist, is high praise indeed.