Bitcoin and Ethereum, the world’s biggest cryptocurrencies by market cap, saw a mixed day on Monday as price chopped between a narrow range.

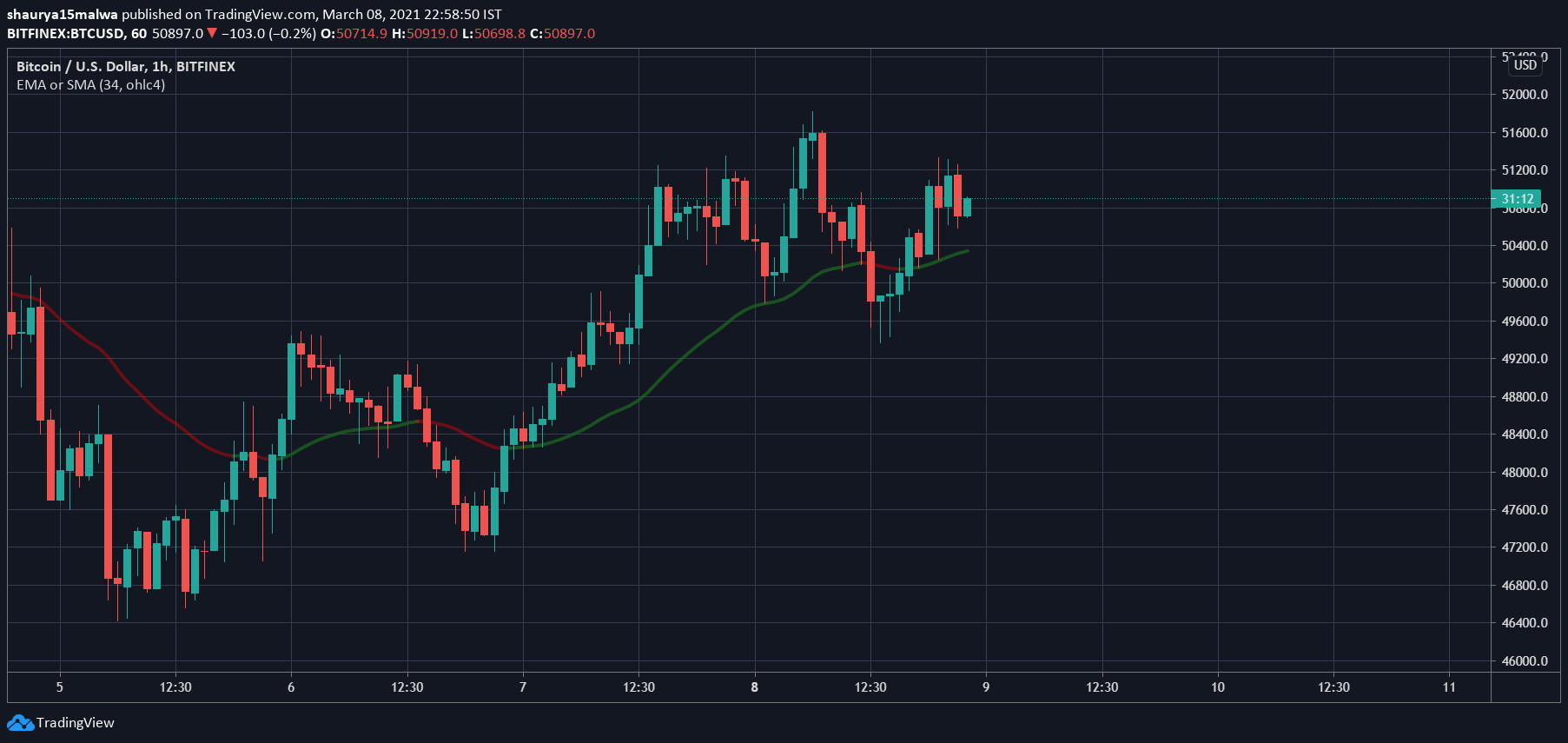

Bitcoin fails to break $51k

Trading data shows BTC traded in the $49,000-$51,000 range this morning, seeing a daily low of $49,316 in the afternoon and a daily high of $51,300 in the evening. The asset plunged in the US hours in line with tech stocks in the country—a correlation that many have pointed out in the past few months.

Bitcoin’s price charts show resistance in the $51,000-$51,200 level, one the asset broke earlier this year while setting its all-time high of over $53,000.

As the above image shows, Bitcoin trades above its 34-period moving average, a tool used by traders to determine the market trend, indicating higher prices in the short term. However, on-chain sentiment data from IntoTheBlock flash a “bearish,” suggesting a decline in prices. The two indicators combined suggest the market remains choppy.

Fundamentally, however, Bitcoin remains in a strong position. Earlier today saw Kjell Inge Rokke, a Norwegian billionaire and founder of oil company Aker ASA, invest over $59 million into BTC.

He said Bitcoin could one day “become the core of a new monetary architecture” and predicted its price to reach “millions of dollars,” but cautioned the bet could “still go to zero.”

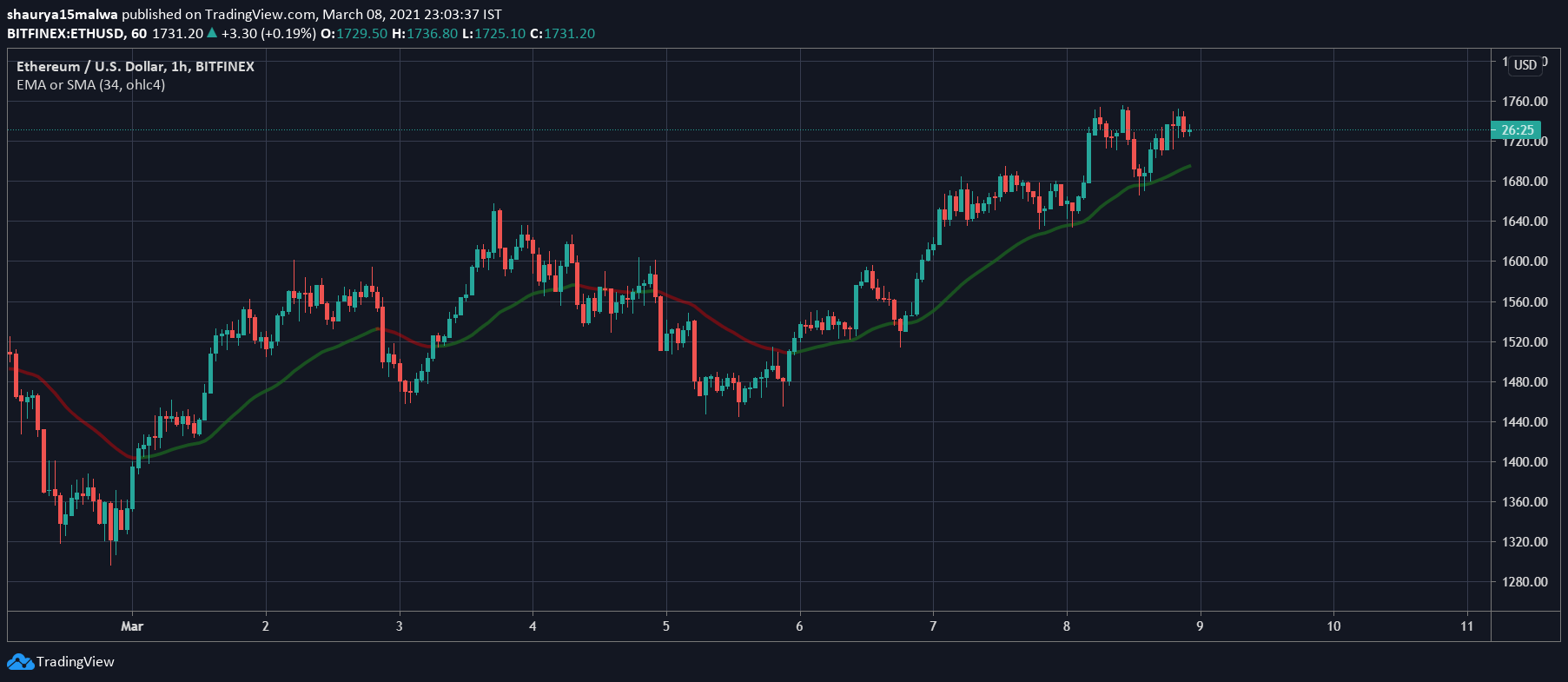

Ethereum upgrade drives it to $1,700…but not beyond

Ethereum, driven by the EIP-1559 catalyst, saw a $150 range and traded between the $1,600-$1,750 price levels. It saw a low of $1,666 in the early afternoon and a high of $1,752 in the evening, tumbling down to its current $1,727 in the US morning hours.

As the below image shows, ETH remains in a strong uptrend (since $1,500) and trades above its 34-period moving average. It saw selling at the $1,750 level, however, but was picked up by traders at the $1,720 level in the US hours.

Apart from the strong fundamental narrative of the EIP-1559, Ethereum saw an institutional push over the weekend. Meitu, a Hong Kong-listed Chinese company, said it had picked up over $22 million worth of ETH (and $17 million worth of Bitcoin) on Friday via a portion of its treasury funds.

It said the assets were a better place to store value than cash, adding the future outlook for both was positive.