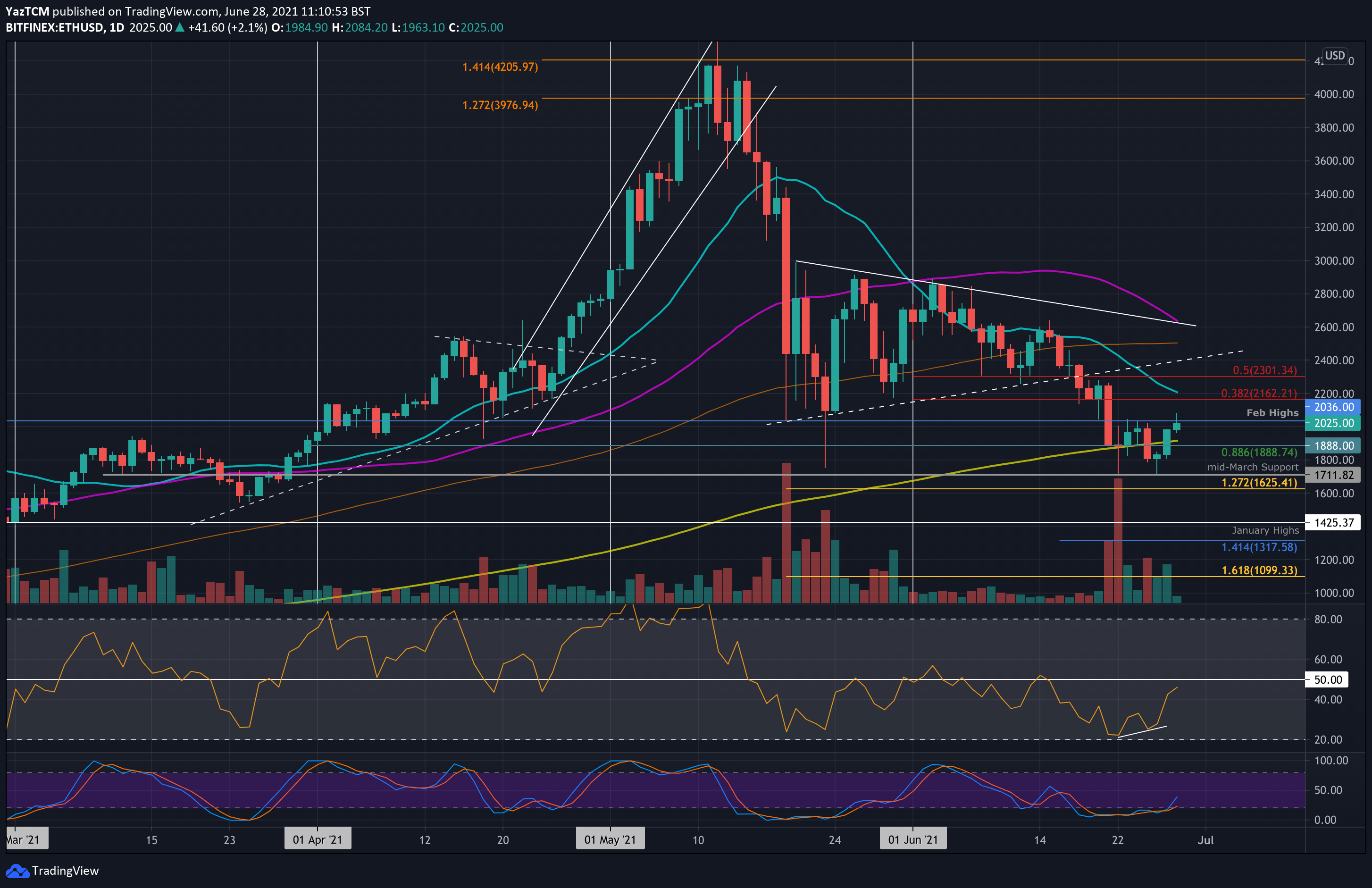

ETH/USD – Ether Reclaims $2000

Key Support Levels: $1888, $1800, $1710.

Key Resistance Levels: $2160 – $2200, $2300, $2500.

Etheruem was trading within a range between $2035 (Feb highs) and $1710 (mid-March support) last week. The cryptocurrency dropped beneath the 200-day MA over the weekend and fell into the lower boundary of this range on Saturday.

Luckily, the bulls quickly regrouped again to close Saturday’s candle above $1800. Since the weekend low, ETH has pushed higher by 17.5% as it breaks back above the 200-day MA and reclaims the $2000 handle.

It would still need to close above the February highs at $2036 to confirm a breakout of last week’s range.

ETH-USD Short Term Price Prediction

Looking ahead, if the buyers push beyond $2000, the first strong resistance lies between $2160 (bearish .382 Fib) and $2200 (20-day MA). This is followed by $2300 (bearish .5 Fib), $2500 (100-day MA), and $2600 (50-day MA).

On the other side, the first support lies at $1888 (.886 Fib & 200-day MA). This is followed by $1800, $1710 (mud-March support), and $1625 (downside 1.272 Fib Extension).

The daily RSI printed bullish divergence over the weekend as it made a higher low while the price action stayed level. It has since pushed higher toward the midline, which indicates decreasing bearish momentum within the market.

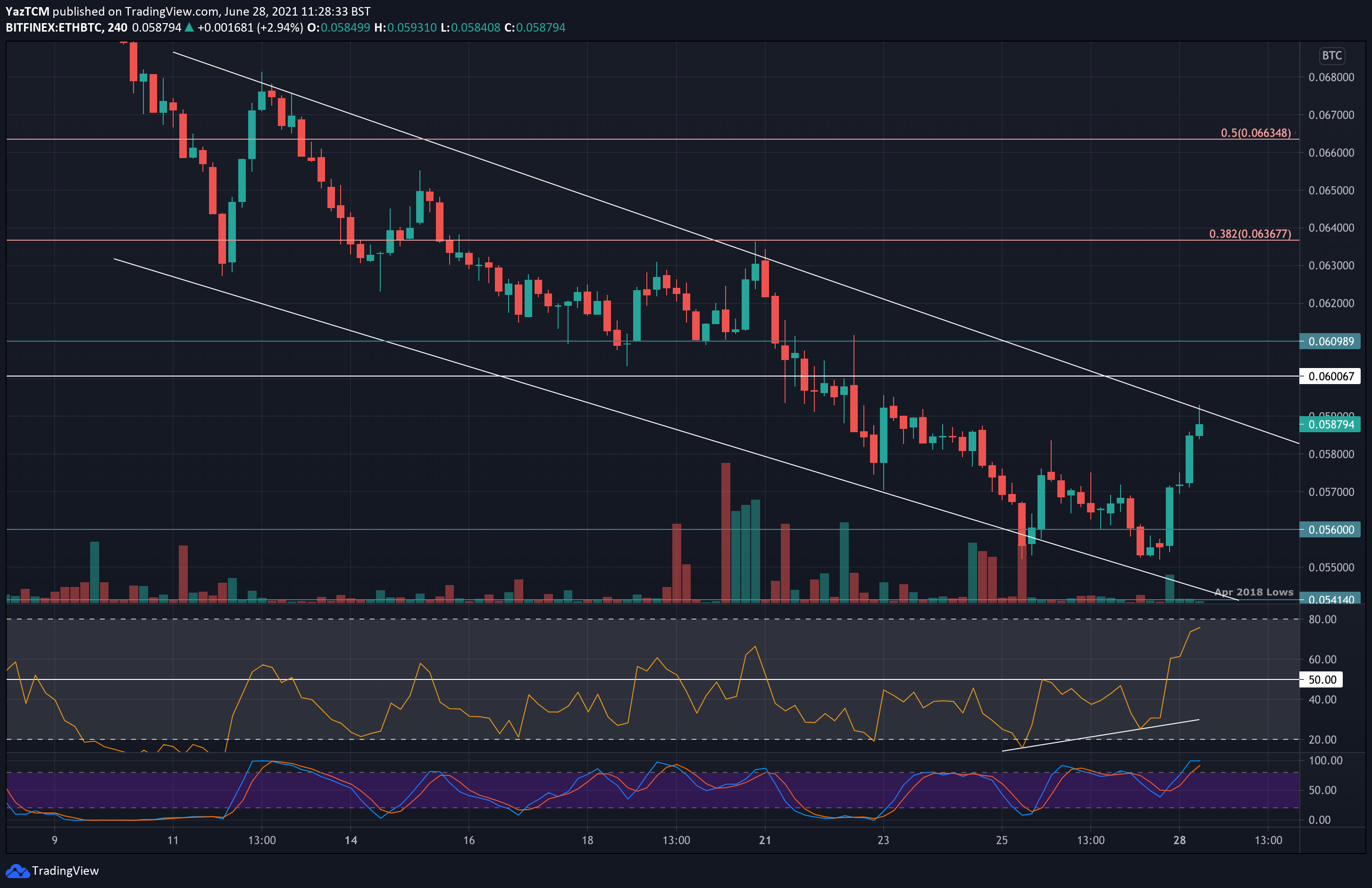

ETH/BTC – ETH Pending Descending Price Channel Breakout

Key Support Levels: 0.058 BTC, 0.055 BTC, 0.054 BTC.

Key Resistance Levels: 0.06 BTC, 0.0615 BTC, 0.0636 BTC.

Against BTC, ETH has been trading in a descending price channel since the first half of June. The cryptocurrency fell as low as 0.055 BTC over the weekend but found support at the lower boundary of the price channel.

It has since rebounded from there and managed to push back above 0.058 BTC to hit 0.059 BTC as it now attempts to break the upper boundary of the price channel. A breakout toward the upside should allow ETH to start recovering back toward the June highs around 0.077 BTC.

ETH-BTC Short Term Price Prediction

Moving forward, once the bulls break the price channel, the first resistance lies at 0.06 BTC. This is followed by 0.0615 BTC (20-day MA), 0.0636 BTC (bearish .382 Fib), 0.0663 (bearish .5 Fib), and 0.068 BTC (50-day MA).

On the other side, the first support lies at 0.058 BTC. This is followed by 0.055 BTC (weekend low & 100-day MA), 0.054 BTC (April 2018 low), and 0.0513 BTC (downside 1.272 Fib Extension).

On the daily chart, the RSI has pushed higher and is approaching the midline. The Stochastic RSI has also produced a bullish crossover signal. On the 4-hour chart, bullish divergence was printed over the weekend, which played out nicely. The short-term momentum is now in the buyers’ favor and is the strongest level since the first week of June.

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to get 50% free bonus on any deposit up to 1 BTC.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.

Tagged with: BLOCKCHAIN NEWS • crypto news