Standard & Poor (S&P) warned that El Salvador’s adoption of Bitcoin as legal tender might negatively affect its credit rating.

The U.S credit rating agency said the knock-on effects could undermine El Salvador’s attempt at securing IMF funding, in turn triggering problems within its economy.

Despite the backlash, President Bukele has always insisted that Bitcoin adoption was brought about for the benefit of the people.

Reading between the lines, El Salvador may well turn out to be a battleground in the showdown between crypto and fiat.

What does S&P say about Bitcoin adoption in El Salvador?

S&P is considered the biggest of the “Big Three” credit rating agencies, with Moody’s and Fitch Ratings placing as the other two.

These firms issue credit ratings for the debt of public and private companies and other large-scale public borrowers, such as governments.

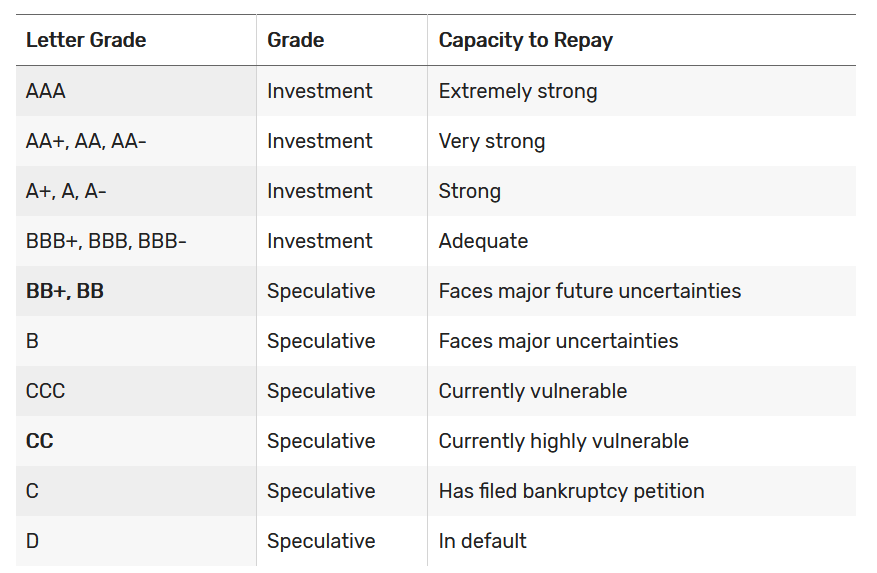

Lenders use agency ratings to determine whether an entity can secure borrowing. It follows that a low rating indicates high credit risk and a greater likelihood of defaulting on loan repayments.

According to Reuters, S&P Global said Bitcoin adoption in El Salvador has “immediate negative implications” for its credit rating.

S&P Global points out that the consequences of this could impact current attempts at securing money from the International Monetary Fund. They also mention more general concerns of increased “fiscal vulnerabilities,” and in hurting banks due to “currency mismatches.”

“The risks associated with the adoption of bitcoin as legal tender in El Salvador seem to outweigh its potential benefits.”

S&P currently grades El Salvador B-. This rating was issued coming up to three years ago, on December 28, 2018.

This rates El Salvador as a speculative-grade borrower, with major uncertainty surrounding its ability to repay. A slide from its current position would make securing loans much harder.

President Bukele talks IMF

International bankers have made clear their position on El Salvador’s Bitcoin adoption.

But President Bukele insists the process was about exercising their sovereign right to adopt legal tenders. He sees little difference between adopting Bitcoin and adopting the U.S dollar in 2001.

“We adopted the U.S dollar in the year 2001. What’s the difference?”

Having said that, President Bukele implied that the backlash boils down to El Salvador actively working to loosen the grip of bankers through Bitcoin adoption.

“The only difference, probably, is the reasons why we are doing this. In 2001, it was probably done for the benefit of the banks. And this decision is done for the benefit of the people.”

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context