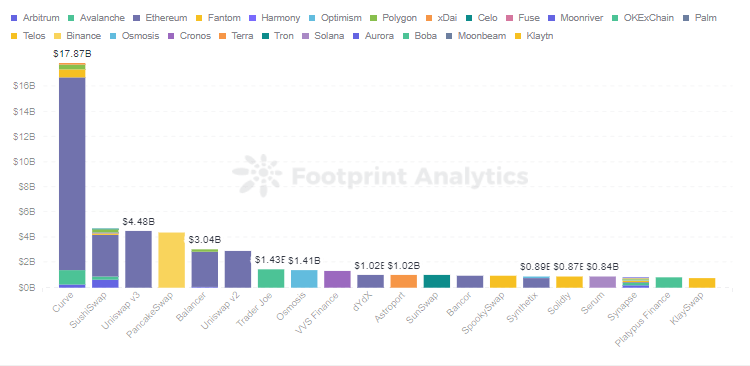

According to Footprint Analytics, as of Feb. 25, there were 372 DEX protocols, totaling a TVL of $62.3 billion, above 30% of the total of DeFi.

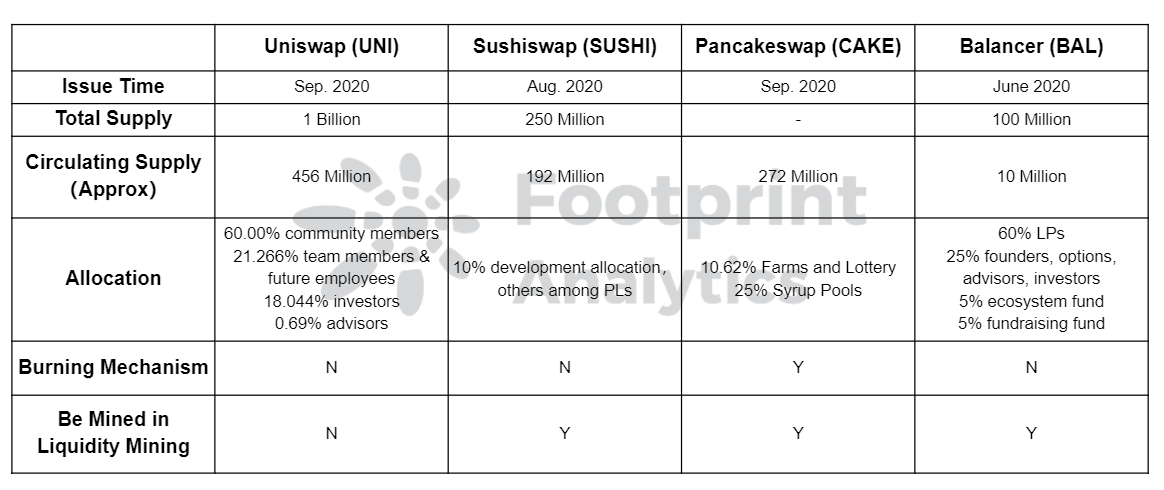

The top 5 DEXes by TVL are Curve, Uniswap, Sushiswap, PancakeSwap, and Balancer. Many DEXes have similar models, but their token economies are not identical. Curve is the largest, but as a stablecoin trading platform, it is slightly different from the others. Therefore, his article will compare the token economies of the other four.

Issuance

The earliest of the 4 to launch was Uniswap as a pioneer of the AMM, in November 2018. But it issued the token UNI two years later, making it the latest. Balancer, Sushiswap, and PancakeSwap all issued their tokens (BAL, SUSHI, CAKE) in 2020.

UNI

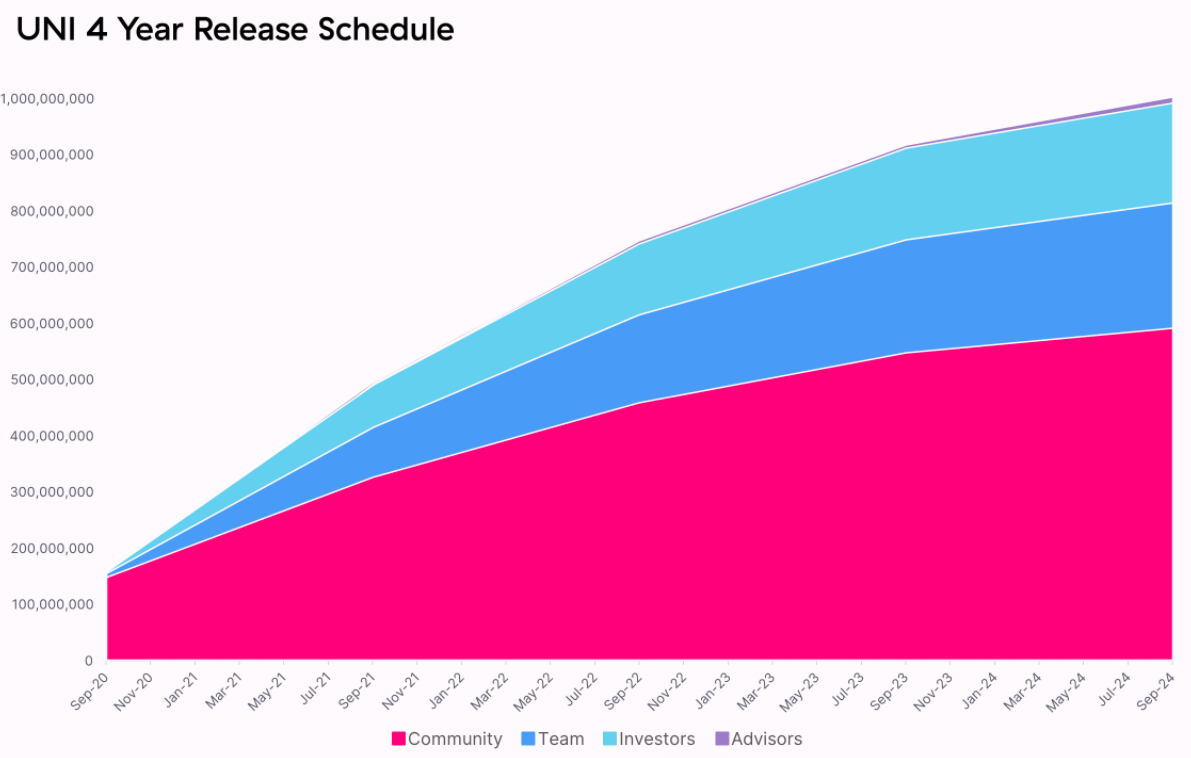

From September 2020 UNI will take four years to complete its initial 1 billion token issue, after which it will be issued in increments of 2% per year for perpetual inflation, to ensure that passive UNI holders can continue to participate and contribute to Uniswap.

SUSHI

Sushiswap essentially duplicates the core design of Uniswap, but it issued a governance token right from launch. It had unlimited issuance when it went live in August 2020, which was later voted on by the community to a maximum of 250 million. It will be fully released through liquidity mining by November 2023, and block rewards will be decreased every month until then.

CAKE

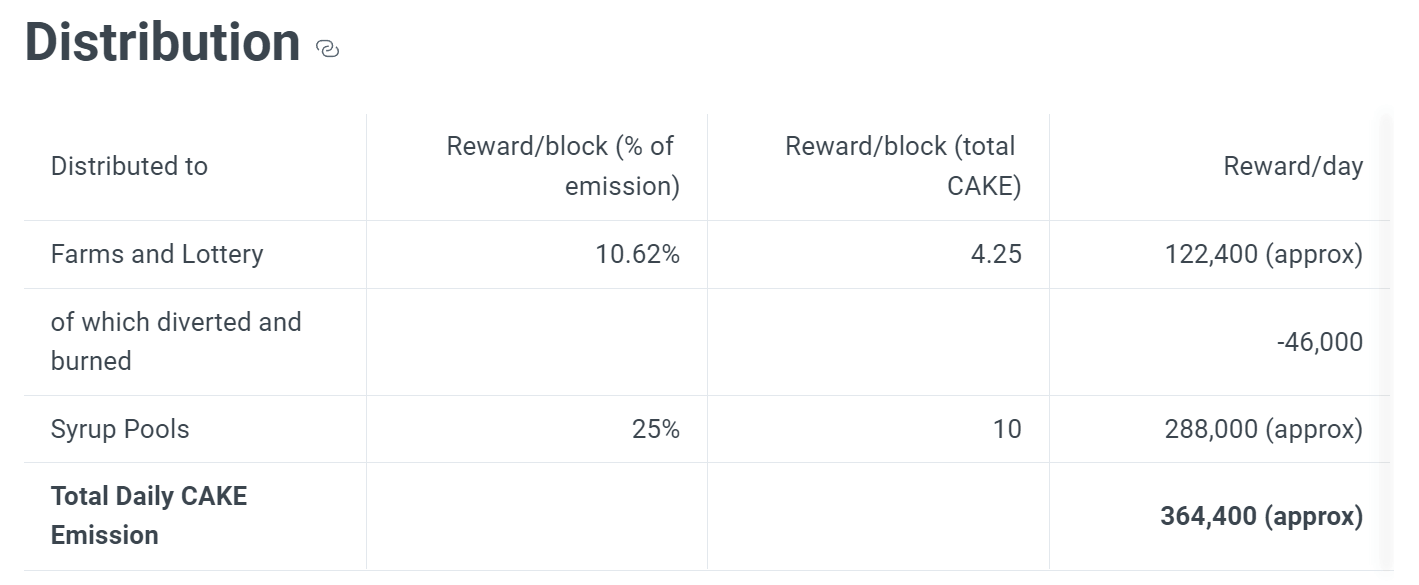

PancakeSwap is a DEX built on BSC. To keep LPs incentivized at all times, CAKE does not have a hard cap, but it has not been affected by selling pressure as UNI was when it went live, mainly to get rise to its deflationary mechanism.

Issuance is reduced by decreasing the number of CAKEs minted per block, and a series of burning mechanisms are in place, such as 20% of CAKEs being burnt when a lottery ticket is purchased. According to Footprint Analytics, the current circulation is 272 million.

BAL

Balancer launched in March 2020 and opened for liquidity mining in June. It features LPs that can customize the ratio of assets in the pool and supports a portfolio of multiple assets.

The maximum supply of BAL is 100 million. 7.5 million BALs are distributed annually through liquidity mining, which will take 8.67 years. BAL’s release rate is much slower than other projects, and this way it can reduce its selling pressure in the secondary market.

Allocation

Allocation of tokens reflects the degree of decentralization of the project.

UNI

The initial issuance of UNI will be based on a distribution plan of 60% in the community, 21.266% to the team, 18.044% to the investors, and 0.69% to advisors. The latter three are set for a 4-year vesting period.

Of the 600 million in the community, 150 million have been airdropped to old users, also released through 4 pools of 5 million each liquidity mining rewards completed. The remaining 430 million will be released over four years in declining annual numbers.

SUSHI

SUSHI is distributed through liquidity pools of 4 million per week. To ensure continuous development and operations, 10% of SUSHI is allocated to the development team.

CAKE

Since CAKE is in unlimited supply, its distribution is slightly different from others. 10.62% is allocated to Farms and Lottery and 25% to Syrup Pools.

BAL

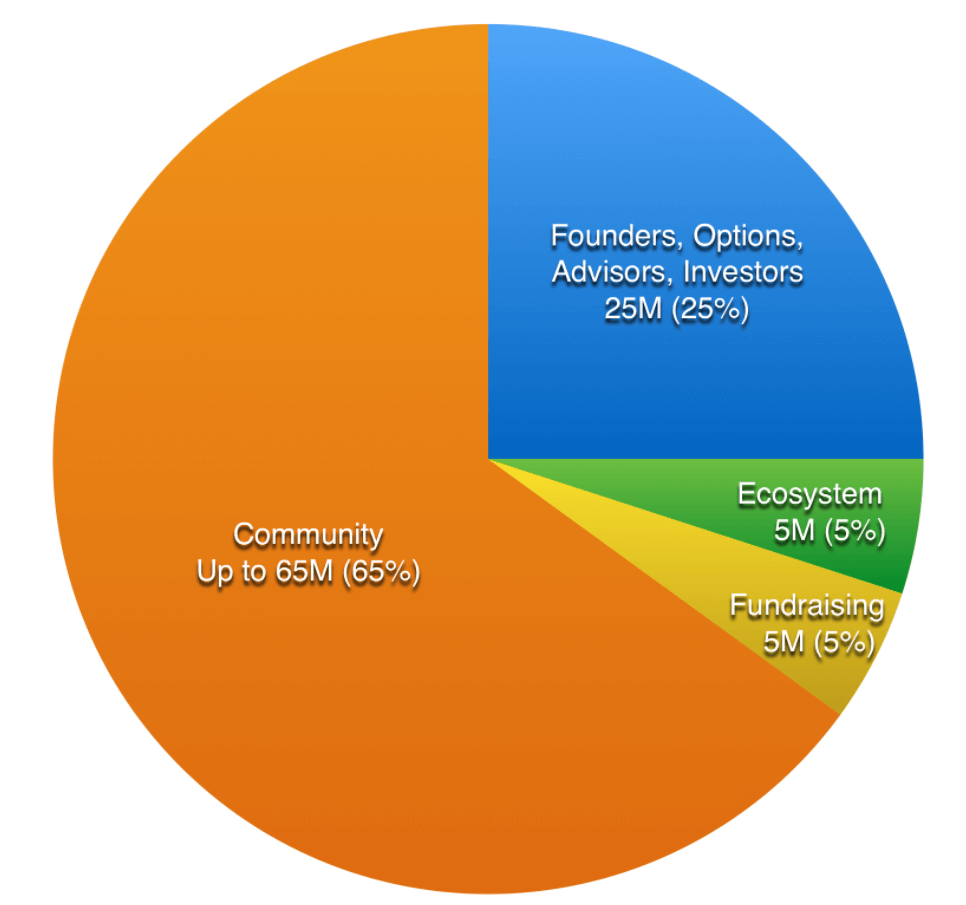

65% of BAL’s maximum issuance of 100 million will be allocated to LPs, 25% to founders, options, advisors, and investors, 5% to ecosystem funds, and 5% to fundraising funds. The portion allocated to founders, options, advisors, and investors is also set with vesting periods.

Balancer takes a more active approach to decentralization by increasing the percentage of BALs held by the community and decreasing those to governance.

Utility and Obtaining Tokens

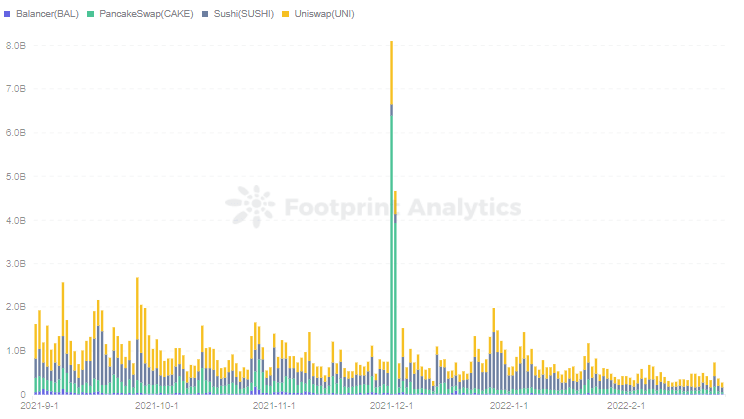

Users can get these tokens by exchanging them on the exchange or by contributing to the community. In addition to UNI, all tokens can be mined for providing liquidity, and CAKE can also be won through the Lottery.

As for governance tokens, token holders can participate in community proposals or votes to determine how the protocol works. There is no shortage of external utilities, especially for UNI in Compound, MakerDAO, and Yearn. CAKE has a wide range of utilities on BSC and can continue to mine other tokens by depositing them in external protocols.

In addition, the utilities for different tokens are also different.

UNI

UNI cannot capture protocol fees. While the ability to capture mitigates selling pressure, UNI’s four liquidity mining pools, which stopped mining in November 2020, also mitigates the potential selling pressure.

SUSHI

SUSHI has an increased token economic incentive over UNI, with a long-term fee distribution for staking SUSHI users (xSUSHI holders). 0.25% of the 0.3% fee paid by traders is distributed directly to LPs, with the remaining 0.05% distributed to SUSHI stakers as an incentive.

The more volume traded in the protocol, the more revenue the stakers receive, and the more it combines the long-term value of the LP and the protocol. However, as more and more SUSHI is mined out, the ability to capture returns from the same amount of SUSHI is gradually diluted. That forces LPs to continually offer to acquire more SUSHI.

CAKE

In PancakeSwap, users can use CAKE to mine more tokens or buy lottery tickets.

BAL

While BAL has fewer utilities than other popular protocols, Balancer announced plans to design veBAL for community governance and revenue capture, taking into account Curve’s token mechanism.

Users can obtain BPT (Phantom Pool Tokens) with 80/20 BAL-ETH providing liquidity and then lock in the corresponding veBAL for 1 week to 1 year. veBAL is similar to veCRV in that it can vote on the reward share of the pool and distributes 75% of the protocol revenue to veBAL holders.

Analyzing the Data

The economic models of the above 4 DEX tokens are summarized as follows.

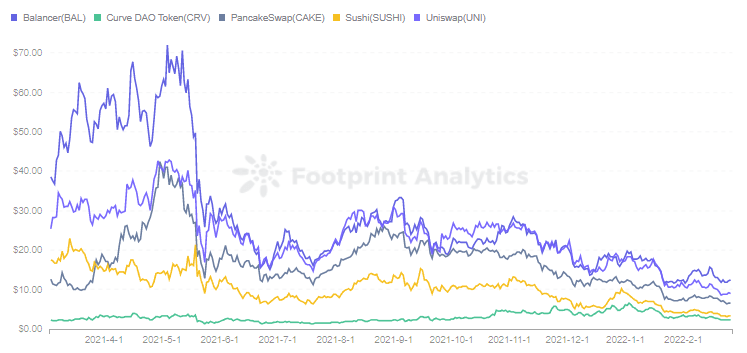

According to Footprint Analytics, BAL has the highest token price as of Feb. 25 at around $12. UNI is next at around $9. DEX is not that high overall.

BAL is trying to achieve decentralization by lowering the team’s token allocation ratio to gain more preference from users. At the same time, due to its long token issuance period, the dilution of token value is slowed down. It is still ranked first after the crash of the price in May.

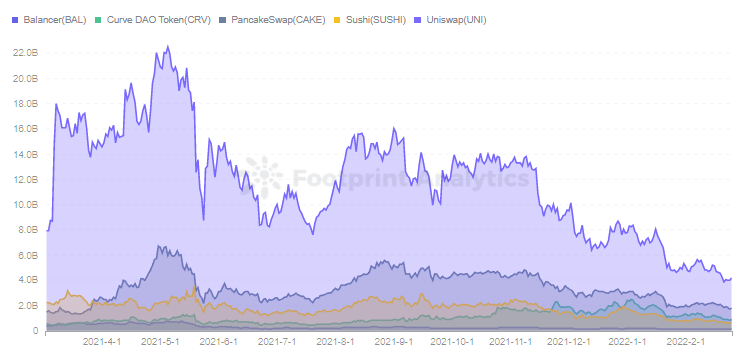

But in terms of market cap, UNI is in the first place ($4.2 billion) and BAL in the last place ($130 million) due to only 10 million in circulation.

In terms of daily transaction volume, UNI, SUSHI, and CAKE are among the top, while BAL is not as active due to fewer external utilities.

The economic model of different tokens is clearly reflected in the data, such as the sell-off caused by the early uncapped SUSHI issuance. Therefore, it is necessary for users to have a detailed understanding before holding.

It also leads us to consider whether a platform issuing tokens through liquidity mining is a protocol for short-term success or long-term development.

Only a protocol with real value can add more TVLs to the platform through such incentives and make it more decentralized through the community. Protocols that lack real value often face a collapse at the end of the incentive, and the token will be worthless. Uniswap maintained its TVL ranking even after it stopped liquidity mining, showing its market value as an AMM pioneer.

The token economic model seems simple, but the inflationary depreciation in value during issuance, the utilities of tokens, and how they can continue to be incentivized after liquidity mining is over are all critical to their long-term value.

This piece is contributed by the Footprint Analytics community.

Date and Author: March 04, 2022, Simon

Data Source: Footprint Analytics DEX Token Dashboard

What is Footprint Analytics?

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects, and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.

CryptoSlate Newsletter

Featuring a summary of the most important daily stories in the world of crypto, DeFi, NFTs and more.

Get an Edge on the Crypto Market 👇

Become a member of CryptoSlate Edge and access our exclusive Discord community, more exclusive content and analysis.

On-chain analysis

Price snapshots

More context