We all know that the overall earnings picture has been very strong, though the ongoing resurge in Covid infections has started weighing on near-term economic outlook, with estimates of Q3 GDP growth sharply coming down in recent days.

Unlike Q3 GDP growth estimates, earnings expectations for the period have not been revised lower, but the revisions trend has nevertheless lost its earlier momentum.

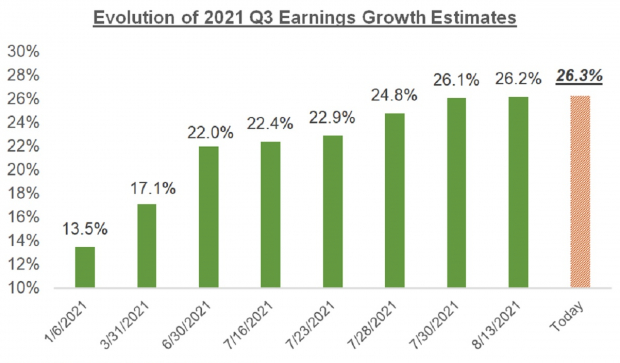

You can see this in the chart below that tracks the evolution of Q3 earnings growth expectations:

– Zacks

Image Source: Zacks Investment Research

What we see here is that while the trend remains positive, it seems to have stalled out sine late July. In fact, the magnitude of positive revisions to Q3 estimates is notably below what we had seen in the comparable periods of the last three earnings seasons.

This loss of momentum is likely tied to the emerging economic slowdown, which in turn is likely a function of the Delta variant. Estimates of GDP growth have been steadily coming down, and currently stand around +3% — roughly half of the growth rate expected a few months back.

We also need to keep an eye on the margins outlook given rising cost trends in labor, inputs, freight/logistics and other line items.

The market appears to agree with the Fed’s assessment of this trend as “transitory” and a function of Covid-related disruptions that will eventually even out. This view is reflected in current consensus estimates, as you can see in the chart below:

Image Source: Zacks Investment Research

This “transitory” view of the ongoing cost pressures is even more pronounced in the annual view of the margins picture, as the chart below shows:

Image Source: Zacks Investment Research

We all know that the “transitory” or otherwise debate has implications for Fed policy, which is as important for the market as the outlook for earnings and margins.

Expectations for Q3 & Beyond

The last earnings season (2021 Q2) not only witnessed a very high earnings growth rate, but the aggregate tally of total earnings also reached a new all-time quarterly record, surpassing the record set in the preceding period. Other positives that came out of Q2 earnings season included the breadth of strength across all the key sectors and the notable momentum on the revenue front.

We know that the unusually high growth rates of the first two quarters will not continue in the last two quarters as they largely reflected easy comparisons to the year-earlier periods that were severely impacted by Covid-related disruptions. Comparisons will be relatively normal in 2021 Q3 and beyond as the U.S. economy had started opening up in the year-earlier period and hence the expected deceleration in the growth pace.

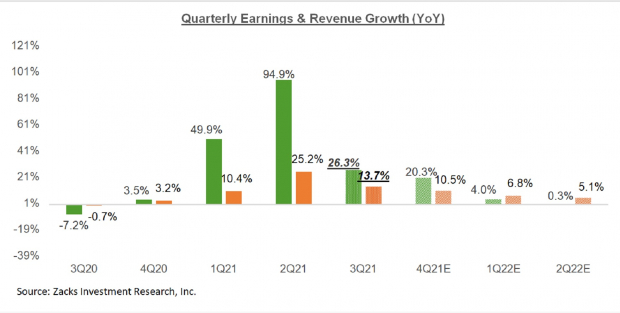

You can see this expected growth deceleration in the below chart that puts 2021 Q3 earnings and revenue growth expectations in the context of where growth has been in the preceding four periods, and the estimates for the following three quarters.

Image Source: Zacks Investment Research

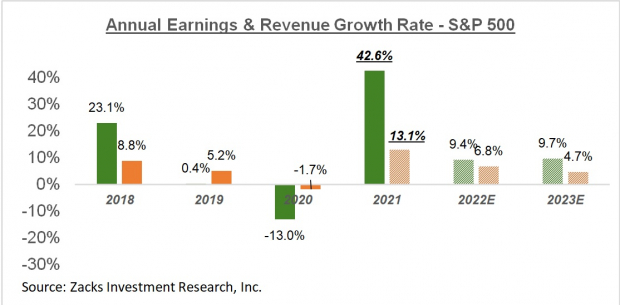

The comparable picture on an annual basis is no less impressive, as you can see in the chart below:

Image Source: Zacks Investment Research

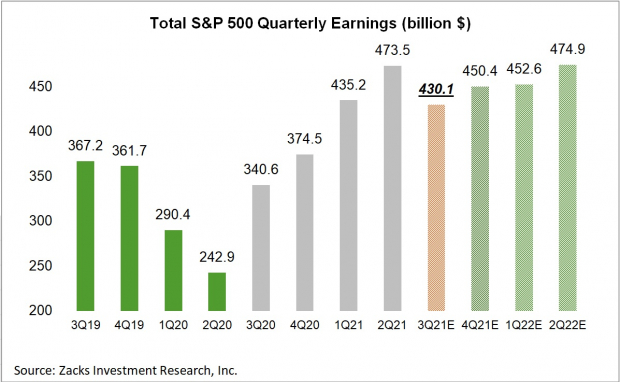

We mentioned earlier how the aggregate 2021 Q2 earnings tally represented a new all-time quarterly record. You can see that in the chart below, with this year’s four quarters highlighted:

Image Source: Zacks Investment Research

We all know that large segments of the economy, particularly in the broader leisure, travel and hospitality spaces are held down by the pandemic, with companies in these areas still earning significantly less than they did in the pre-Covid period. In fact, many of these companies aren’t expected to get back to pre-Covid profitability levels for almost one more year.

The impressive feature of the record earnings in each of the last two quarters is that they were achieved without help from these key parts of the economy.

Earnings Season Gets Underway

We will be counting Oracle’s ORCL report after the market’s close on Monday, September 13th, as first report of the Q3 earnings season.

Oracle will be reporting results for its fiscal quarter ending in August, which we count as part of our Q3 earnings tally. A number of other bellwether operators like FedEx FDX, Nike NKE, Costco COST and others will also be releasing their fiscal August quarter results in the coming days.

By the time JPMorgan JPM and other big banks start reporting their September-quarter results on October 13th, we will have seen such August-quarter results from almost two dozen S&P 500 members.

For a detailed look at the overall earnings picture, including expectations for the coming periods, please check out our weekly Earnings Trends report >>>> Looking Ahead to the Q3 Earnings Season

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

JPMorgan Chase & Co. (JPM): Free Stock Analysis Report

NIKE, Inc. (NKE): Free Stock Analysis Report

Oracle Corporation (ORCL): Free Stock Analysis Report

Costco Wholesale Corporation (COST): Free Stock Analysis Report

FedEx Corporation (FDX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research